As the price of oil goes up, reserves previously uneconomical to exploit become attractive. Nuala Moran explores the chemical technology being used

As the price of oil goes up, reserves previously uneconomical to exploit become attractive. Nuala Moran explores the chemical technology being used

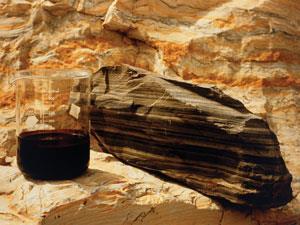

Getting fossil fuels out of the ground is neither cheap nor easy. However, some barrels of oil are easier and cheaper to extract than others, flowing out of reservoirs of their own accord, as pressure is released. The problem is that the amount that can be extracted in this way is dependent on the conformation and porosity of the bedrock. In some reservoirs, as little as 10% of the total reserves can be recovered so easily. Tapping the rest involves extra effort – and extra cost.

Unsurprisingly, the balance between effort and cost informs the behaviour of the companies that extract fossil fuels. How easy does extraction need to be? It depends on oil and gas prices. As they rise, a greater proportion of global reserves becomes cost-effective to extract.

And since the start of the 21st century prices have been very high indeed. This price incentive has unleashed a wave of chemical technologies designed to do two things: enable the extraction of shale resources that previously were considered irrecoverable; and increase the output from conventional oil fields.

Spurred on by concerns about energy security, much of the early funding to develop the technologies for exploiting shale-bound reserves came from the US Department of Energy (DOE). But it was prolonged high prices – with crude prices above $100 (£66) per barrel for most of 2012 – that fostered translation of this research through to exploration and exploitation of shale resources that formerly were off limits. In parallel, high oil prices are driving the application of new chemical methods for increasing the proportion of oil extracted from traditional sandstone and limestone reservoirs.

New chemical technologies are being married to innovations in other areas including: machinery for drilling and pumping, seismology, computer modelling of reservoirs and molecular scale mineralogy. Many of the technologies now coming into widespread use are in fact decades old, having been created during previous oil price shocks only to be parked when the price later fell. They are now being dusted down in the face of sustained high prices, concerns about energy security, rising demand and the imperative to make the most of finite resources.

Traditional resources

A widely quoted industry figure is that on average only a third of the oil contained in any reservoir is recovered using the conventional two-stage extraction method. In the first stage, oil held under pressure flows out of its own accord. When the subsequent fall in pressure reduces the flow, a second stage of recovery begins in which water and gas (natural gas, nitrogen or carbon dioxide), or water alone, are pumped in to increase the pressure again and sweep more oil out. The remaining two-thirds is held in small pockets or distributed in pores in the rock and cannot be extracted in this way.

It is at this point – in the tertiary exploitation of a reservoir – that enhanced oil recovery (EOR) techniques, which employ steam, chemicals or alternating water and gas injection, come into play. The price of oil is the leading incentive for the deployment of chemical EOR, according to David Sorin of Novecare, a business unit of Belgian speciality chemical company Solvay that focuses on EOR. ‘At $30–40 per barrel, you wouldn’t bother,’ he says.

The adoption of EOR is also driven by the perception that the technologies are becoming more mature and the realisation that, as a finite resource, fossil fuels should be exploited as fully as possible. In particular, such sentiment is motivating national oil companies whose activities are confined within the borders of the country. This is the case in Oman, Malaysia and Argentina, for example. ‘They can’t find new reserves and so there is no other option,’ Sorin says.

The two main classes of chemicals used in EOR are polymers and surfactants, which are added to the water before it is pumped in to push the oil out. Polymers increase the viscosity of the water, thereby raising the pressure it exerts. A relatively narrow range of polymers is available and the choice has to be validated for each reservoir.

But the returns from using polymers to increase the viscosity of the pumping water diminish over time, as the remaining oil is increasingly held to the rock surfaces by capillary forces that resist the viscous water and the risk of fractures caused by continuously increasing the pressure becomes significant. This is when surfactants come into play, breaking down the interfacial tension between the oil and water, and thereby helping to liberate the oil from the rock. Selecting the appropriate surfactant is a precise task, requiring detailed understanding of the temperature, salinity and mineralogy of the reservoir.

Shell was one of the pioneers in developing surfactants for use in chemical EOR in the 1970s. Since then, researchers have honed the technology so that much smaller amounts of surfactants are required and it is possible to precisely manipulate their molecular structure, enabling surfactants to be tailored to a particular reservoir. The increased precision improves on the unsuccessful attempts to deploy chemical EOR. ‘20 or more years ago, there were failures, primarily because of a lack of detailed design and evaluation. Now, we have filled the gaps on the chemistry side and also on the analytical laboratory side,’ says Sorin.

As EOR projects differ from reservoir to reservoir, the increase in yields varies too. A 10% increase is regarded as a good result, but in some cases chemical EOR can add 20%, taking the total oil extracted to 50–60% of the available reserve. Chemical EOR costs $20–40 for each additional barrel of oil. ‘In other words, you wouldn’t do it at any cost [of crude oil] and that’s why it didn’t fly in the past,’ Sorin explains.

Back to basics

Attention has also been turning to improving the traditional methods of sweeping reservoirs by pumping in gas or water. A notable example is the ‘LoSal’ technology deployed by BP, which draws on fundamental chemistry research carried out by the company to find out what makes oil molecules to adhere to rock surfaces. They found that oil molecules are bound to clay particles within sandstone by divalent cations such as calcium and magnesium. In high salinity water, in which there is a high concentration of ions, the oil is strongly held to the surface of the clay by elecrostatic forces. When the salinity is reduced, the divalent cations are swapped for monovalent ions such as sodium, breaking the bond and allowing the oil molecules to be swept towards the production well.

Following a successful field trial in the Endicott field in Alaska, BP is now applying the LoSal technology in the Clair Ridge field in the North Sea to the west of Shetland, where $120 million will be spent on installing a plant to desalinate seawater. At a capital cost of just $3 per barrel, the desalination plant will more than pay for itself, says Andrew Cockin, technology leader at BP. In trials, LoSal has increased yields by up to 10%, although Cockin says the improvement is unlikely to be as large in live projects.

Others have attempted to improve the efficiency of using carbon dioxide to increase reservoir pressure in the secondary stages of production. For example, scientists at the University of Pittsburgh, US, are developing carbon dioxide ‘thickeners’, to prevent ‘fingering’, when the gas follows the path of least resistance and bypasses pockets of oil rather than sweeping them to the production well.

Again, this is a technology with a history. The Pittsburgh researchers first demonstrated it was possible to design additives that would make carbon dioxide viscous in the 1990s, but they were too expensive. Now, work is in hand to develop low-cost versions that could increase the viscosity 100-fold. Robert Enick, one of the scientists working on this project, says that if the viscosity of carbon dioxide could be increased to a value comparable with oil, ‘fingering would be inhibited, the need to inject water would be eliminated and more oil would be recovered more quickly, using less carbon dioxide’.

Natural gas currently flared in the North Sea could be used for sweeping reservoirsThe carbon dioxide used in US oilfields comes from natural sources, but the thickening technology could prove to be particularly valuable. The industry is turning its thoughts to creating a virtuous circle by using anthropogenic carbon dioxide to increase yields and at the same time sequester this greenhouse gas in spent oil reservoirs.

There are carbon capture and storage (CCS) projects in the UK aiming to deposit carbon dioxide from coal-fired power stations in spent North Sea oil fields. It is ‘common sense’ to first use the gas to push out more oil, according to Jon Gluyas, who studies CCS at Durham University in the UK.

Gluyas spent 28 years working in the oil industry, including 10 years redeveloping dead or dying fields. ‘There are a lot of mature fields with rather a lot of oil left in them,’ he says. ‘Past experience, for example, in the west of Texas, shows that pumping in carbon dioxide works well.’ However, there are technical issues such as high pressure and acidity – with their impact on the pipes – that need to be overcome before carbon dioxide from power stations in the UK can be captured, transported and stored for use in the North Sea.

Similarly – although not as effective as carbon dioxide – natural gas currently flared or vented in the North Sea could be used for sweeping reservoirs. Gluyas argues that, rather than stopping production and decommissioning rigs in mature fields, a range of EOR technologies should be applied to make the most of the North Sea’s maturing oil fields. ‘If we abandon the North Sea now, we will never go back to it,’ he says.

Frack attack

As with chemical EOR, hydraulic fracturing (‘fracking’) to exploit oil and gas reserves in shale is a technology with a long history, dating back to the 1930s. Systematic attempts to develop methods for extracting ‘unconventional’, hard to access resources did not begin in earnest until 1979 when the DOE published its report ‘Commercialisation plan for the recovery of gas from unconventional resources’.

‘The technologies were around before, but they were around in a crude form. There has been more innovation because of concerns about supply and because of the high price of oil,’ says Wallace Tyner, a specialist in energy and natural resources policy analysis at Purdue University’s Global Policy Research Institute in West Lafayette, US.

The fine grain size of shales means oil and gas do not automatically flow out under pressure and it is not possible to sweep the reservoir with water or gas. Instead, fractures must be propagated in the rock using pressurised fluid containing a complex mixture of chemicals (see High hopes for shale feature). These chemicals serve a number of roles, including controlling the viscosity of the fracking fluid, etching new channels, keeping the fractures open and protecting equipment.

‘Drilling capabilities are particularly important, but in fracking the chemistry is extremely important also, and the chemical cocktails that are used have evolved over time,’ says Tyner.

The dimensions of cracks generated by fracking are variable, but a typical fracture might be 1cm wide by 30m high, extending over 100m. As the pressurised fracking fluid opens a crack, materials known as proppants are pumped in to keep it open. They need to be strong, to prevent the crack from closing, and permeable, to allow the flow of oil and gas to the well. Commonly used proppants include sand, ceramics and sintered bauxite.

Modern refinements of these proppants include resin coated sands that form a lattice, preventing grains from moving as the oil and gas is extracted, and ultra-light proppants made of porous ceramic or cellulose–resin mixtures. Selecting the best proppant is crucial to optimising the productivity of a reservoir, and requires good analysis of the properties of the shale, including particle size and density. Other key chemical ingredients of fracking fluids are breakers, which reduce the viscosity of the fluid once the fracture has been generated. This helps to ensure the fluid deposits the proppant as it moves through the crack.

Future trends

The oil and gas held in shale deposits was once thought to be irrecoverable. The DOE’s investment in research, coupled with the price incentive to translate these technologies, means the US has seen a surge in gas production from these sources. It is now poised to overtake Saudi Arabia as the world’s biggest producer of crude oil in 2013.

My sense is that $60 per barrel is the low where the technology backs out

As Bob Dudley, chief executive of BP, noted during the company’s annual ‘Outlook on global supplies’ presentation in January, average oil prices from 2007–2011 were 220% above the average for 1997–2001. These high prices are supporting the expansion of supply, underpinned by the development of new technologies, as the shale revolution illustrates. Oil and gas from shale will ‘account for almost one fifth of the increase in global energy supply to 2030,’ Dudley said.

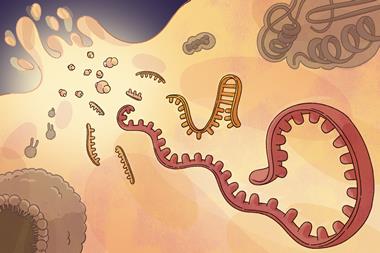

Newer technologies are also waiting in the wings, including the use of supercritical carbon dioxide for oil recovery, applying electrical pulses rather than fracking water to make fractures in shale, and microbial EOR, in which bacteria would be used to digest oil. The DOE is continuing to invest in R&D for EOR, in particular looking at ways to optimise the use of supercritical carbon dioxide to overcome the problem of fingering.

Oil companies are focusing on technologies for improving recovery levels, both in-house and in collaborations with academics and specialist companies. For example, scientists at Shell are working on chemical EOR with the University of Texas Center for Petroleum and Geosystems Engineering in the US. At the same time, the company also has a research agreement with the oilfield services company Schlumberger to increase recovery rates and extend the life of oil and gas fields.

Tyner notes that the DOE has three reference prices – $200, $135 and $60 per barrel – against which it assesses the cost–benefits of EOR and technologies for exploiting unconventional resources. ‘My sense is $60 per barrel is the low where the technology backs out,’ he says. But the continuing growth in demand for oil, in particular from developing countries, means the wave of innovation is set to continue.

Nuala Moran is a science writer based in Crewe, UK

No comments yet