Over the past decade there has been a dramatic increase in the number of drugs prescribed to pets. What are the factors behind this trend, asks Elisabeth Jeffries

Over the past decade there has been a dramatic increase in the number of drugs prescribed to pets. What are the factors behind this trend, asks Elisabeth Jeffries

First there was bird flu from Asia. Now a pandemic of swine flu, as it is popularly known, has emerged from Mexico.

But behind the tabloid headlines, another, slower and steadier form of sickness seems to have been developing over recent decades among the animals nearest to us - our pets. Millions more cases of arthritis, heart disease and cancer are being reported in pets than was the case 15 or 20 years ago, and all these new cases have generated a whole new line of business - medicine for companion animals - for the pharmaceutical industry. From anti-inflammatories to appetite suppressants, pets are now being treated with a range of drugs not that much narrower than those prescribed for humans.

In the 12 months to December 2008, members of the UK National Office for Animal Health (Noah) - which represents about 90 per cent of companies operating in this area - rang up ?451.4 million of sales of animal medicines in the UK, of which just over half were for drugs intended for pets (the balance going to farm animals). These range from treatments for parasites to vaccines, antimicrobials and geriatric medicines.

Pfizer, a leader in the field, estimates the global market for animal medicines reached $18 billion (?11 billion) in 2007; animal drugs now represent about 4 per cent of total pharmaceuticals business, according to specialist consultancy Vetnosis.

But the question that springs to mind is why this sector should have grown in recent years - after all, pet ownership is not new. According to Phil Sketchley, chief executive of Noah, this is due to changes in human lifestyles. ’The pet population has increased substantially, plus there is better health awareness. It used to be enough [just] to feed and take the dog for a walk.’

Now, he suggests, demographics are changing; more people in towns have pets, there is a new breed of childless pet owners, and there is more pressure to treat animals well. Cats, he says, are more popular than dogs among urban professionals, but other species are also generally more popular than they used to be, such as rabbits. Last but not least, companion animals are living two or three years longer. At the same time, the financial services industry has grown, and along with it a major new sector - pet insurance. ’A lot of

the market is driven by pet insurance, which has grown substantially over the last ten years,’ comments Jamie Day, editor of trade journal Animal Pharm.

Rick Goulart, a spokesman for Pfizer in the US, also argues that social changes have affected people’s attitudes to pets. ’There’s an increasing demand for pet health,’ he claims, refuting the idea that it is about new illnesses or longer life. He reckons that over the years, ’society has seen more and more people viewing pets as a member of the family. There’s a growing bond that’s more meaningful.’ As Day puts it: ’It’s an emotional issue, where money is no object - it’s part of people’s discretionary spend.’

New drugs on the block

Claire Fowler, a veterinary officer at pharmaceuticals manufacturer Boehringer Ingelheim, views the issue slightly differently. ’It’s a chicken and egg situation. Pets have a good quality of life and are living longer. Is that due to the new generation of pet medicines, or has that new generation of medicines become available because of their longer lives [and need for more treatment]?’ she asks. Previously, only anti-inflammatories, some vaccines and a few other treatments were available. Pet euthanasia took place when the pet became too ill to function normally.

There are other, broader reasons for the growth of the sector. In the 1990s, livestock production was relatively depressed, especially in Europe. ’The driving force was an agricultural contraction in the developed world,’ explains Day. As a result, pharmaceutical companies began to intensify their interest in this area and dedicate more of their R&D spend on it. Fifteen years down the line, their efforts have become very successful.

According to Fowler, new trends have emerged, and people are treating diseases not previously noticed. ’Arthritis in cats is an issue that came out of the woodwork,’ she says. ’Previously, vets were recognising maybe one case a year, whereas now it is recognised as being just as common in cats as in dogs.’ Different medicines have emerged for all sorts of pets - not just cats and dogs, but ferrets, ornamental birds and reptiles. Niche products have also emerged. Pfizer, for example, sells Palladia (toceranib phosphate). A new treatment for cancerous tumours in dogs, formulated as a tablet that can be used in place of intravenous chemotherapy, it is the first cancer drug aimed specifically for canine use to be approved by the US Food and Drug Administration (FDA).

A second Pfizer drug, Cerenia (maropitant citrate), was originally designed to control nausea and vomiting during cancer treatment. However, it is also used for motion sickness, and can be given to dogs accompanying their families on long distance American journeys during the summer holidays, for example. ’Pet owners had only previously looked at human drugs to sedate the dog,’ explains Goulart.

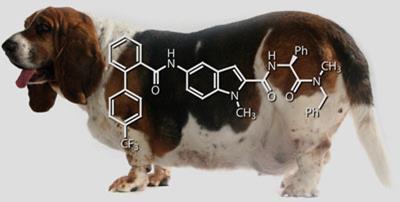

The company even produces a drug for obesity in dogs. As Goulart points out, a dog’s weight is the responsibility of the pet owner. ’In these cases, we found the caregiver has struggled with managing the weight of the dog. The dogs in these families have many opportunities to eat all the food they want, so - like humans - they develop cardiovascular problems,’ he explains.

The product, called Slentrol (dirlotapide), was originally tested as a potential treatment for overweight people, but was found to cause undesirable side-effects, from abdominal distension and flatulence to headaches. Slentrol blocks the assembly and release of lipids from the gut wall into the bloodstream - as carnivores, dogs can tolerate much higher levels of fat in the diet than humans, and avoid some of the side-effects caused by preventing lipid absorption.

Taken in a liquid form, Slentrol is intended to suppress the dog’s appetite while it gets used to a new diet. If the plan works, the dog begins to take more interest in exercise and play and starts to lose weight, and eventually comes off the drug.

Other companies have developed a range of medicines for various conditions, from Amoxycare, a broad spectrum penicillin suitable for a range of species; to Isofane, an anaesthetic; to Purevax Felv, a vaccination against feline leukaemia; and Stronghold, a medicine used against flea infestations and roundworm. ’Tick and flea treatment is the bread and butter of sales in the industry,’ says Day. Vaccines are another major source of income.

A spoonful of sugar

If the development of pet medicines is a fascinating example of smart marketing, it is also a reflection of the innovation within pharmaceutical company laboratories. Several effective new treatments have been developed, but there is a surge of research activity aimed at changing the form of the medicine to improve delivery. ’Developing medicines that are easy to use is a major market trend,’ remarks Fowler. This includes, for instance, converting previously solid (tablet shaped) medicines into liquid form, extending the duration of an injection’s therapeutic effect, developing products that only need to be taken once instead of three times a day, and making products more palatable for the animal.

Pfizer has been one of the companies leading this research. ’Veterinary medicine has evolved dramatically over the last 40 to 50 years,’ says Robert Docherty, of Pfizer’s global R&D division in Sandwich, Kent. He too acknowledges the need for change: ’People want to make it easy to administer the medicine - they are in a hurry and want a palatable format’. For instance, Pfizer has introduced a flavoured form of Rimadyl, an anti-inflammatory often used to treat chronically degenerating joints, because dogs and cats so often spit out tablets. This has proved a success.

’The challenge is to have palatable tablets that cross both species,’ says Docherty. For cats, that means a product that appeals to their sense of touch and feel. For dogs, that means a sweet taste. But this apparently simple adaptation means considerable trials, because the addition of a flavouring agent could affect the product’s shelf life and efficacy. Bio-availability, chemical stability and manufacturability are the three issues scientists concern themselves with when adding a flavouring agent or adapting a drug in any way. At the same time, there are limits to what the researchers may do, because marketing departments want a limited range of products on the shelf, according to Docherty, with dosage being the main variant. Hence, some finicky work is necessary: ’We work on understanding the crystal shape and properties of the compound to make a robust formulation,’ he explains.

When developing injectable medication, the scientists have to work with a number of issues, including the time taken for the injected site to clear, the solubility of the product, its precipitation and its viscosity. Plus, according to Docherty, an injectable has to be cheap - $3 to $5 per phialed formulation. In the case of Convenia, a new medicine for cats and dogs that tackles skin and urinary tract infections, they made an unusual step forward. ’It is an antibiotic vets have been getting excited about,’ asserts Rick Goulart.

To treat these conditions previously required the animals be given an injection of antibiotics once or twice a day. The Pfizer team has developed an antibiotic that only needs to be administered once a month. Ensuring that the pet does not receive too strong a dose on that one occasion was a major challenge the researchers needed to solve, which they achieved by modifying the active ingredient to slow its metabolism in the bloodstream.

Delicate dosage

Medication for dogs creates particular challenges, because they have a much wider range in weight and size than most other species, including humans. This means producing a particularly versatile drug, since it would be impractical to rely on such a wide range of dosage forms. Palladia, the canine cancer drug, is an interesting example. ’It’s not necessarily more effective than if a human cancer drug were used,’ remarks Goulart, ’but it is specifically designed for how a dog manages and processes it internally, as humans absorb and manage the drug slightly differently.’ But the similarity between the two highlights the logic of dovetailing human and animal medicine - at least as far as mammals are concerned. Just as humans can catch animal diseases, so animals can benefit from therapies initially developed to deal with human illness. Palladia would never have developed without the extensive cancer research under way in many pharmaceutical companies.

But there is also a solid commercial logic underpinning the development of animal medicines. As Day puts it: ’Blockbuster products are not making as big advances, and the research effort is not getting the profits back that the pharmaceutical companies are used to.’ Some of the research aimed at solving human diseases can be applied to animals, so that some of the huge start-up costs associated with a completely new medication are avoided. This means that some of the margins on animal pharmaceuticals are higher than they might have been - although of course many other factors also affect the margin size, including how the product is sold. In a market that, in the case of some human conditions, is saturated, this parallel universe is bound to be attractive to pharmaceuticals producers. ’They are leveraging basic research for use for other things,’ says Day. The result has been a productive seam of new revenues.

Going one step further, animal research is entering the genetic age - and could have an impact on genetic research for a new wave of human therapy. Dogs suffer from many of the same illnesses as humans, and their genetics are less complicated because much of the dog population exists as ’pure breeds’; this genetic isolation means there are fewer complicating variables to consider. A European project known as LUPA has been set up to collect DNA evidence from dogs with particular diseases in order to work out which genetic characteristics might be associated with which diseases. So although many human illnesses originated in animals, our four-legged companions may also hold the secret to the cure of many others.

Elisabeth Jeffries is a freelance science writer based in London, UK

No comments yet