As big pharma turns its back on antibiotics in the wake of growing drug resistance, biotech companies are stepping in to develop new therapies

As new cases of resistance to available drugs continue to grow, new therapies to replace them are desperately needed. But the majority of large pharmaceutical firms have decided that the antibiotic market is not an arena they want to invest in - and only six new antibiotics have reached the market since the turn of the millennium. Now, biopharmaceutical companies are moving into antibiotics, and filling the void left by big pharma.

’In the antibacterial space there is continued resistance emergence and the armamentarium that clinicians have available to them is becoming continually compromised,’ explains Steve Gilman, chief scientific officer of antibiotic experts Cubist Pharmaceuticals.

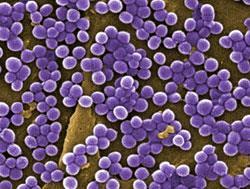

In the late 1990s only around 15 per cent of Gram-positive Staphylococcus aureus (S. aureus) strains were resistant to beta-lactam antibiotic drugs like methicillin, explains Gilman - now those methicillin-resistant S. aureus (MRSA) strains account for between 60 and 70 per cent of the infections caused by the species.

’Without continued research and development into drugs like Cubist’s Cubicin (daptomycin) that can fight MRSA we would have a much bigger problem than we have now,’ says Gilman.

He warns that while some headway has been made against multi-drug resistant Gram-positive bacteria like MRSA, multi-drug resistance in Gram-negative bacteria has grown to between 15 and 20 per cent. But finding ways to stop these bacteria may prove harder as their cell walls are much more complex than Gram-positive bacteria and prove harder for drugs to penetrate.

Upping the pace

’The charge right now is really being led by the biotech companies in terms of discovery and early development,’ says Guy Macdonald, chief executive of Tetraphase, one of the biotech firms working on next generation antibiotics.

There is a fresh sense of urgency in the race to find new antibiotics, Macdonald tells Chemistry World - particularly those that are effective against Gram-negative strains - as some people are predicting that resistance is growing at such a rate that there could be a ’return to the pre-antibiotic era’ in the next five to six years.

’The company was founded in 2006 and our novel chemistry platform has helped us identify three new drugs in just three and a half years,’ says Macdonald. The most advanced of those is about to enter Phase II clinical trials and is a broad spectrum, intravenous tetracycline antibiotic - only the second to be introduced in the past 50 years.

’The old approach to making tetracyclines was to use semi-synthesis - fermentation, followed by a small amount of chemistry at the end,’ says Macdonald. Instead, the company makes use of a fully synthetic process developed by Andrew Myers at Harvard University in the US to make tetracyclines. ’We are using the chemistry [Myers] developed to make changes to the core tetracycline molecule that people could never make before,’ says Macdonald.

’This has led to us identifying a very wide range of active compounds, and the challenge has really become matching up molecule profiles with those areas of greatest need.’

But even once a drug is identified, the fight against emerging drug resistance is ’almost a catch 22’ says Macdonald. ’Despite the great need for new antibiotics, even when you develop a new drug to fight resistant strains you get significant resistance to using them from hospital staff because they want to protect against resistance to the new drugs developing’.

Mark Leuchtenberger, chief executive of drug design firm Rib-X agrees: ’You may find the drugs kept behind glass like a fireman’s axe, to only be used in emergency.’

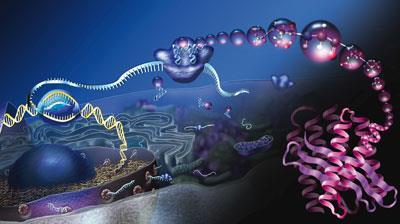

Rib-X was set-up by 2009 chemistry Nobel prize winners Tom Steitz and Venki Ramakrishnan to make use of their ground-breaking work that pinned-down the structures of the ribosome to develop new antibiotics. According to the company, around half of all antibiotics target the bacterial ribosome. By studying how known antibiotics bind to the ribosome and combining those results with computational chemistry, the firm is designing new drugs that overcome the resistance problem.

’Using the Nobel prize winning technology we have managed to design three completely novel scaffolds that have no history of use as antibiotics, so the excitement that we and our pharma partners feel is intense, says Leuchtenberger

’We’ve also used it to understand the binding of Zyvox (linezolid), which has sales of $1.1 billion (?716 million) a year, and the crystal structure data showed us that immediately adjacent to the binding site is an incredibly rich binding site that Zyvox doesn’t cover, because like every other company the inventors didn’t have the window into the ribosome that we have,’ says Leuchtenberger.

The company used that insight to rationally design a drug, radezolid, that binds 10,000 times more strongly to the Zyvox binding site, but also wraps around and covers the other side of the ribosome. ’That broadens the coverage so it doesn’t just fight Gram-positive bacteria but Gram-negative ones as well,’ says Leuchtenberger.

While financial incentives are no doubt a boon to any drug developer, when asked what they would ask governments and regulators to change, Macdonald and Leuchtenberger feel what is really lacking is firmer guidelines, and ensuring pharma companies are given more notice of upcoming changes, rather than modifying them in the middle of a clinical trial.

’You get clarity on your safety and efficacy fairly quickly, but unfortunately the regulatory goalposts keep moving,’ says Leuchtenberger.

If regulators want to avoid scoring an own goal in the fight against increasing bacterial resistance, then setting firmer guidance must indeed be top of their agenda, especially as those developing the drugs are the smaller biopharma companies that can least afford unexpected extra costs.

Matt Wilkinson

No comments yet