Clubbing together gives contract research organisations more power to win new business in an evolving market

Attracting new business is essential to the success of a contract research organisation (CRO). A group of specialist companies based in and around Nottingham’s BioCity small business incubator has found that, by making the most of each other’s expertise and presenting a united front, they can offer a more comprehensive suite of services, which translates into securing more business.

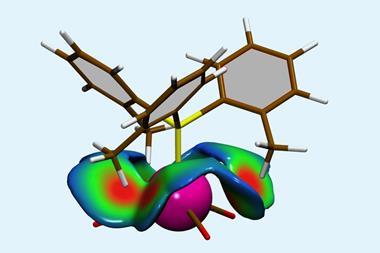

Between them, the companies cover pretty much the full range of drug discovery activities. Aurelia Bioscience covers compound screening to identify hit and lead molecules, which Charnwood Molecular can synthesise and pass to XenoGesis for drug metabolism and pharmacokinetics (DMPK) testing. Through a collaboration with French company Hybrigenics, Charnwood can also probe drug-protein interactions to identify potential drug targets or off-target effects. Reach Separations pitches in with analytical and chromatographic expertise, particularly for chiral compounds, and Source Bioscience adds DNA sequencing and molecular biology services.

The key thing, explains Richard Weaver from XenoGesis, is that no single company is trying to become a one-stop shop. Each focuses on its own strengths, but by developing strong relationships and understanding each other’s capabilities, they can work together very effectively and become more competitive. On the flip side, he says, the arrangement is rather informal and non-exclusive. There’s no requirement to bring in other partners when their services aren’t required. That gives each company the freedom and flexibility to operate efficiently and helps reduce redundancy, which keeps clients’ costs down. ‘It comes down to building trusting relationships,’ says Sylvain Blanc from Charnwood. ‘There’s a lot of work that we just wouldn’t get if we couldn’t rely on Reach for chiral separations, for example.’

Reach’s Peter Ridgway cites two recent meetings the companies set up in Switzerland, with representatives from potential clients across the Swiss pharmaceutical sector, organised in conjunction with UK Trade and Investment (UKTI). ‘When I first started having conversations with UKTI, I realised that if I went just as Reach, offering chiral separation, there was no way they would have been able to get enough people interested in coming to see us to make it worthwhile,’ he says. ‘But with Charnwood, Aurelia and XenoGesis involved, we got the audiences.’

As companies get more comfortable with the idea of outsourcing, the way they approach it is evolving, says Ridgway, and this kind of cross-pollination between providers is only going to grow. Clients recognise the value of specialist expertise, and appreciate the quality and turnaround speed that dedicated organisations can provide. ‘When we first started, it was difficult to convince some people that taking their lead chemist away from the fumehood for several days to do separation work wasn’t cost effective,’ he says.

But that’s changing. More and more drug research is being done by small and medium-sized enterprises, universities and even ‘virtual’ companies with some kind of idea or intellectual property assets but little physical presence, and certainly no lab space of their own. Government funding agencies are pushing researchers to commercialise their work. That means the demand for contract research is increasing, and the number of providers is also growing, often based in the numerous science parks and incubators popping up on sites vacated by big pharma. ‘We are starting to get more requests from academic groups,’ says Charnwood’s Paul Bradley. ‘Even when some of them have the ability to do things in-house, they recognise that as a business we’re more delivery-driven, so we might get the job done quicker or more efficiently.’

No comments yet