Big companies are partnering with smaller ones – without trying to gobble up all their intellectual property, Anthony King finds

Twenty start-ups travelled to Gothenburg, Sweden, this year to attend Imagine Chemistry, an AkzoNobel Speciality Chemicals competition. They were invited by the Amsterdam-headquartered company to ‘work with us as equal partners’ to find solutions in areas such as sustainable small particle technologies and waste-water-free chemical sites.

Four entrants won a joint development agreement with the company, but all 20 finalists got mentoring and made contacts within the company. The finalists were chosen from 150 ideas submitted in six challenge areas. This event exemplifies a trend in open innovation: rather than drawing start-ups closer to obtain their intellectual property, some firms are shifting to a more collaborative approach. ‘We don’t want to own the start-ups,’ says AkzoNobel chief executive Thierry Vanlancker. ‘It might not even be an exclusive relationship.’

This strategy foresees collaboration agreements, or business support, and subsequent shared ownership of intellectual property (IP) as a way of introducing innovations into a large company. ‘This is not like a beauty contest where you perform, win a cash prize and then we take your idea. This is about cooperation and shaping something together,’ says Lars Andersson, general manager of performance chemicals at AkzoNobel. Finalists spent three days with experts in R&D, finance, innovation and marketing, with no equity sought nor IP acquired.

‘We’ve got a confidentiality agreement so they can be very open,’ says Andersson. Sometimes large companies steal ideas from smaller ones, or try to muscle in on their IP, an attitude likely to frighten away innovative start-ups. A more collaborative approach can convince the best start-ups to play ball.

In the past, corporations had substantial internal R&D arms to generate new ideas and new products. With many reducing that capacity, they must now look beyond their own expertise and allow ideas to flow in from the outside. This willingness to look outside underpins ‘open innovation,’ a concept coined in the 1990s and written about by Henry Chesbrough at the University of California, Berkeley in the US. ‘Culturally, it requires the recognition that not all the good people work for you,’ explains Roy Sandbach, who spent over three decades at Procter & Gamble holding global R&D positions and is president of the Royal Society of Chemistry’s Industry Council.

When the term first appeared, many large companies fretted about loss of IP. Today, the speed of change and digitalisation revolution in so many sectors has made open innovation imperative. A chemical company might need a mesh of software, hardware or artificial intelligence solutions to solve a problem, but the best place to find that solution lies outside its R&D department. ‘The open innovation paradigm is built on the fact that there are massive technology revolutions,’ says Alberto Onetti, economics professor at the University of Insubria in Italy and president of advisory firm Mind the Bridge Foundation. A large corporation can be tied to its own history, research legacy and expertise, which although assets can also stymy it in terms of flexibility in emerging disciplines, especially where disciplines meet.

‘Innovation tends to happen at boundaries,’ says Sandbach, who recalls that even such a large organisation as P&G began to struggle from the year 2000 onwards to host the boundary-spanning digital and scientific expertise. ‘We were being asked to innovate for all of the brands more quickly than even a large R&D organisation could manage.’ The solution was to open up a dialogue between in-company experts, who knew what was needed, with those outside, who had the potential solutions.

Different paths to open innovation

There are a few popular strategies for engaging outsiders in innovation. One is to simply acquire promising start-ups and smaller competitors. Vanlancker at AkzoNobel believes this is not always the best option for either party: ‘There are too many examples where a start-up gets incorporated into a big company and then gets suffocated.’ Another move is to invest strategically in start-ups, so you can keep a watch on them. There are also online challenges, where entrepreneurs or start-ups are rewarded say $100,000 for succeeding to meet a client’s needs – InnoCentive is an example of an intermediary that runs such a programme.

Accelerators, which provide entrepreneurs with some facilities and tutelage, are a popular and more collaborative option. Y Combinator is a showcase example from the US that nurtured Airbnb, Dropbox and Reddit. Accelerators give large companies a heads-up as to what nimble start-ups are working on and allows them to network with this community. But large corporations struggle by themselves to set up accelerators, warns Onetti. ‘Internal corporate accelerators do not work. Most corporates are either abandoning accelerators, outsourcing them or participating with other corporates.’ Others see them becoming a more mainstream strategy for large companies. ‘There’s been a considerable shift in UK accelerators. Around 2014, about a quarter were funded by corporates. Now around 60–70% are,’ says Sandbach. He agrees that corporates on their own are often ill equipped to run them, but increasingly are joining forces or teaming up with specialists.

An example of a joint approach is AgroStart, which saw BASF team up with accelerator specialist ACE to develop digital start-ups in the agri-sector in South America. This requires an online application, followed by a pitch in person; successful candidates enter a 10-month acceleration programme.

‘There are a gazillion approaches [to open innovation],’ says Onetti. ‘Lots are currently under exploration and a lot of them have already failed.’ Companies must create the right incentives. ‘Over 80% of start-ups fail. When you start a company, chances are you will lose time and money,’ says Onetti. He advises large corporates therefore ‘not to leverage their own position too much so as to give start-ups the right incentives’. In 2013, Bayer began giving out grants to innovative healthcare apps in its Grants4Apps programme, offering mentoring, office space, networking and financial support. The rights to software and technology, however, remain with the applicant.

There is another solution that skirts around IP issues entirely. ‘One way to approach an open innovation programme is to make the first step a fee for service, which avoids questions of equity sharing and non-disclosure agreements,’ says Sandbach. ‘They provide the input and you own the output.’ Onetti refers to this as the co-development or procurement model, which allows a company to engage with a start-up strategically and buy their product or service. ‘This strategy is really cost-effective,’ he says, noting that his organisation Mind the Bridge often works as a scout for bringing start-ups to the attention of large companies.

The potential benefits from open innovation will drive companies to experiment with new formats and solutions. ‘Companies have struggled to find models that really fit with their specific needs,’ says Georg van Krogh, an innovation researcher at the Swiss Federal Institute of Technology in Zurich, who sees three benefits that are making open innovation the norm. First, it can reduce the cost of innovation, as available solutions are taken in from the outside. Second, you can be faster to the market. For example, if you consider developing a new car, it is quicker to involve others in the myriad technologies and materials needed. Third, open innovation reduces the risk of failure, since customers or suppliers are usually more involved. It can also cut down on duplicating research effort within a sector.

In the UK, the Structural Genomics Consortium (SGC) is a public–private partnership to support new drug discovery in a collaborative effort. Close to 90% of drugs in Phase I do not make it to the marketplace and the traditional focus on R&D secrecy and IP protection has wasted resources by duplicating efforts. ‘The least efficient process you can imagine is big corporates like AstraZeneca and GSK doing the same piece of research, which wastes enormous amounts of money. This has to change,’ says Sandbach. The high attrition rate for candidate drugs helps explain why the average cost of a new drug approved in the US was estimated at $2.6 billion (£2 billion) by a 2014 study. Chas Bountra, a structural biologist at the University of Oxford in the UK and chief scientist at SGC, notes that the productivity of pharma R&D has suffered a long and slow decline, despite dramatic advances in our understanding of molecular biology and waves of consolidation in the private sector.

A policy paper he co-authored argues that the experience of the last two decades shows that increasing the volume of research funding and extending IP protection fails to enhance R&D productivity.1 ‘Many of us are worried that as a biomedical community we are not producing enough medicines and when we do they are increasingly unaffordable,’ Bountra explains. He calls for a new approach to restart the sputtering engine of drug discovery.

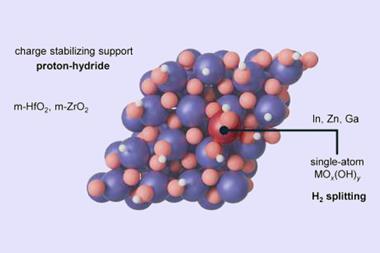

The SGC pools resources and expertise, and explores new drug targets, biomarkers, and technologies to generate more affordable drugs more quickly. The goal is for drug companies to together generate pre-competitive IP-free science that they can tap into. ‘Currently we are getting funding from nine large pharma companies,’ says Bountra. ‘We pool resources and share risk.’ It includes AbbVie, Bayer, Boehringer Ingelheim, Janssen, Merck, Takeda and Wellcome. The consortium deliberately works on targets or protein families that are viewed as intractable or undruggable to generate novel reagents and so drive innovation. ‘The pharma industry is increasingly recognising that this early discovery research just cannot be done inside their four walls,’ Bountra explains. The SGC also built a network of 300 academic labs worldwide and is tapping into the resources and knowledge of large pharma.

Not the end of R&D

Peter Nieuwenhuizen, chief technology officer of AkzoNobel Specialty Chemicals, initiated Imagine Chemistry in 2017 to help tackle chemistry challenges in a new era. He sees the chemical industry as having navigated first through an initial phase of using fats and oils from natural sources, and then from the 1950s using petrochemical sources. We are entering a third phase: the circular economy, where making materials from petrochemicals and then discarding them is no longer acceptable. ‘Existing companies need to change to stay relevant. It is important to source ideas from the outside,’ he says. Imagine Chemistry creates links between people and begins a dialogue that will benefit AkzoNobel beyond the formal joint development agreements.

‘Here we work as equals,’ says Nieuwenhuizen, who frequently encounters concerns by start-ups of having their IP ripped off, and prefers the term ‘collaborative innovation.’ Connecting people is a crucial first step. This is also the approach of Synergy, a Royal Society of Chemistry programme that tackles cross-sectoral innovation challenges. Last year, it brought together academics, start-ups and large companies including BP, AkzoNobel, BASF and Saudi Aramco together to discuss the issue of corrosion. ‘We bring experts together from diverse industries and organisations around a challenge that no single entity can tackle alone,’ explains Jenny Lovell, programme manager for innovation at the RSC. Next up is an innovation challenge on polymers in the circular economy. Success is counted in the number of collaborations such events trigger.

The RSC will run its sixth Emerging Technologies Competition this year, with the final taking place at Chemistry Means Business 2018 on October 15 in London. Eight winners will be announced for four categories: health; energy and environment; food and drink; and materials and enabling technologies. Each will receive tailored business support from partner companies: Pfizer, Croda, Unilever, Mondelēz GE Healthcare and Diageo. ‘It is an opportunity for them to find new technology and find people to collaborate with,’ Lovell explains. Again, linking the right people with the solutions to the industry people who know the problems is key.

Still, for companies to collaborate with university research entrepreneurs or start-ups, they must get over the hump of the ‘not invented here’ syndrome. ‘You have to take a humble attitude and say we have smart people, but there might still be things to learn from these other sources. We might not be smart on everything. Let’s be humble and learn,’ says van Krogh. ‘That is not easy. In many companies people rise to the top by not being humble.’ Similarly, trying to squeeze the very best deal out of a smaller would-be partner can backfire. Nonetheless, there is no going back to a world of internal R&D teams deciding the direction of all innovation.

This does not mean that R&D departments in large companies are going to shrivel or be substituted by outside experts. The exact opposite is predicted by many who have studied innovation trends. ‘A company’s ability to absorb knowledge depends on the investment they have made in R&D. It is just that they become more efficient and effective at R&D,’ says van Krogh – by being open to outside expertise. ‘In many areas, you don’t know what you don’t know, so you need dialogue with the outside,’ says Sandbach.

It is also about recalibrating where the R&D effort goes in. Bountra’s policy paper recommends, for instance, that drug companies create schemes that allow research staff to contribute a percentage of their time to open science drug discovery initiatives. R&D will remain a core competency within companies and is needed to participate in fruitful collaborations. ‘If your R&D capabilities diminish then you won’t be in a position to judge your open innovation opportunities,’ Sandbach concludes. ‘Almost all the big players are asking themselves what is our core competency. The answer to that question is still research and development.’

Anthony King is a science writer based in Dublin, Ireland

Acknowledgment

Akzo Nobel covered the expenses of the author attending the Imagine Chemistry event in Gothenburg

References

1 C Bountra, J Lezaun and W H Lee, A New Pharmaceutical Commons: Transforming Drug Discovery, Oxford Martin School, 2017 https://bit.ly/2KRBpNy

No comments yet