Western governments look to overcome Russian dominance of key uranium processing steps

Nuclear energy shuffled into the spotlight in December with a declaration at the COP28 climate meeting to triple its capacity by 2050. The declaration lauded the role of nuclear energy in achieving global net-zero greenhouse gas emissions by 2050.

Yet many industry watchers doubt this ambition can be achieved. ‘If I was a betting man, I would give ten-to-one odds against this happening,’ says Matthew Bunn, a professor of energy and foreign policy at Harvard University, US. Not enough new reactors are being built.

Meanwhile, the supply of fuel for nuclear reactors is complicated by a reliance on Russia at various points in the supply chain and often a lack of profit for commercial companies involved, which compete against state-backed enterprises in Russia and China.

Uranium is not the main constraint on the supply of nuclear fuel. ‘There’s plenty of uranium in the world,’ says Bunn. Everyone knows how many nuclear reactors are operating, and how much uranium they need. ‘So you would expect prices to be pretty darn stable,’ he explains. ‘That expectation would be wrong.’

Price surge

The price of uranium rose sharply towards $90 (£70) per pound in the second half of 2023, having hovered around $20/lb in 2017, and risen to over $40/lb after the Russian invasion of Ukraine in 2022. The main drivers ‘are rising demand coupled with a lack of sufficient supply response,’ says Jonathan Hinze, president of UxC, a market research firm for the nuclear industry.

Kazakhstan is the world’s largest miner of uranium, with around 40% of total production. While some additional mines are expected there, ‘we really need to see more new mines in places like Canada, Australia and Africa,’ says Hinze.

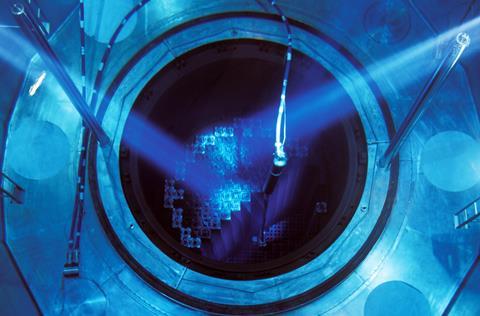

Mining is only the start. The supply chain runs from a mine through three more steps; each is a market onto itself. Uranium is mined and milled into uranium oxide (U3O8), then shipped to facilities for conversion into uranium hexafluoride gas (UF6), in preparation for enrichment.

Mined uranium is 99.2% U-238 and just 0.7% U-235. Enrichment plants use thousands of centrifuges to enrich U-235 to about 5%, as needed in a typical power plant. But enrichment brings in geopolitics. ‘Unfortunately, concentrating it to 3-5% for a commercial reactor uses exactly the same technology as concentrating it to 90% for a nuclear bomb, and it is an exponentially accelerating process,’ says Bunn.

After enrichment, UF6 is converted to uranium dioxide (UO2) and fabricated into fuel pellets and rods, designed for specific reactor types. The format required depends on who built the reactor, whether it’s a French, US, Chinese or Russia design. A pressurized water reactor generating 1GW of electricity, for example, might contain over 50,000 fuel rods with over 18 million pellets.

Conversion constraints

Kazakhstan is a behemoth in mining, with 13 active mines producing almost 19,500 metric tonnes in 2020. Australia produced 6200 tonnes, Namibia 5400 tonnes and Canada 3800 tonnes. But the Kazakhs rely on Russia for processing uranium into UF6, with Russia holding almost 40% of global conversion market, ahead of China and Canada, with France some way behind.

‘Conversion is extremely constrained at the moment given recent plant outages and other operational challenges,’ according to Hinze. ‘The move by the West and other markets to reduce or eliminate reliance on Russia means that other producers must ramp up capacities to make up for the loss of Russian supplies.’

Unsurprisingly, Russia also holds a significant share of the enrichment stage, with 46% market share in 2018. The state company Tenex supplied 30% of enrichment services to EU utilities in 2019, according to a recent report from the Center on Global Energy Policy at Columbia University in New York, US.

‘Russia is fairly important in the conversion market, but doesn’t have to be,’ says Bunn. There is under-used conversion capacity in several other countries. ‘[But] Russia is hugely important in the enrichment market.’ Enrichment is tougher to change, and is partly a legacy of the Cold War, when Russia ran huge facilities for its civil and military nuclear industry.

Even the US imports enriched uranium from Russia, which started with a programme dubbed ‘megatons to megawatts’ that saw large amounts of highly enriched weapons-grade uranium converted into fuel for US power plants. This ran from 1993 to 2013 and is viewed as one of the world’s most successful non-proliferation endeavours.

The US government privatised its enrichment facilities, creating the United States Enrichment Enterprise in 1992, reborn as Centrus in 2014 following bankruptcy. Meanwhile, Soviet uranium processing facilities continued operating. ‘They had these huge enrichment plants with not much to do, so they offered low prices and got a lot of business,’ says Bunn. ‘Because Russian enrichment was cheap, we all got dependent on Russia.’

Rosatom (Russia) is the biggest enrichment services provider, followed by Urenco (UK, Netherlands, Germany and US) and Orano (France). ‘Urenco, for example, did not expand its capacity, because there was no profit incentive,’ says Bunn. ‘The market was oversupplied with enriched uranium.’

Changes are afoot. In October 2023, Orano said it plans to increase its enrichment capacity in the south of France by nearly 30%, to reduce the dependence of its customers on Russian supplies.

Chinese demand

China, however, has built up substantial conversion and enrichment capacity, exceeding its civilian needs. ‘The Chinese have been expanding their capacity like gangbusters because these are state-owned companies. They don’t have to worry about the profit situation,’ says Bunn. ‘They worry about cut-offs of foreign supply and being self-reliant.’

Some of this enriched uranium will be used to produce weapons, some may be exported. For uranium, China has adopted a three-market strategy: investing in domestic uranium mines, buying mines overseas to send uranium back to China, and buying supplies on international markets.

Between 2010 and 2020, China built 36 new nuclear reactors, according to the International Atomic Energy Agency. The building of nuclear power plants in China has slowed more recently, says Bunn: ‘They’ve built a heck load of electricity plants and have more electricity than they need.’ Another drag is that new plants can attract public opposition and the Chinese authorities take protests into account when evaluating the performance of local government officials, Bunn adds.

While Western powers discuss moving away from an overreliance on Russia for conversion and enrichment, they are loath to swap for dependence on China. ‘The world outside of Russia and China is quickly moving away from supplies from these nations,’ says Hinze. ‘However, these moves mean that costs of nuclear fuel are rising and supply chains are becoming tighter.’

Russian reactor reliance

Russia has also been also a major exporter of reactors in recent decades. There are Russian reactors operating in Russia, Ukraine, Hungary, Czechia and Slovakia and elsewhere. More are being built, for example in Turkey, Hungary, Bangladesh and Slovakia. ‘Russia even offers build and operate contracts, where they will come and build you a reactor without you paying a penny,’ says Bunn. ‘They’ll operate the reactor and make the money back on electricity sales over the decades.’ Russia will also take back spent fuel. It’s state company, Rosatom, has large projects with Iran, South Africa and Egypt, among others.

The Chinese have been expanding their capacity like gangbusters because these are state-owned companies. They don’t have to worry about the profit situation

This can render countries reliant on Russia for the operation and/or maintenance of their reactors. And, since each type of plant requires specific fuel assemblies, Russian-designed reactors traditionally use Russian-made fuel. ‘Russia is going to be a big player in nuclear markets for a long time in the future,’ Bunn predicts.

A recent analysis examined Russia’s nuclear energy diplomacy in the context of the war in Ukraine. Since Rosatom is fully owned by the Russian state, it can be used to exert political pressure and project power globally. ‘For most Western-aligned states, it will be inconceivable to enter into any type of new dependence or even non-dependent cooperation with Russia in the nuclear energy sector,’ the authors note.

Nonetheless, alternatives are emerging. In September 2023, US nuclear services provider Westinghouse delivered the first fuel assemblies for Russian-designed reactors in Ukraine from a fabrication facility in Sweden. Ukraine praised the move as the end of the Russian monopoly in this section of the nuclear fuel market.

‘The key question now is how fast Westinghouse can scale up, given that there’s a bunch of countries with Russian-designed plants,’ says Bunn. Others, too, are moving to support domestic fuel supply. Saparro 5 is a group of five nations (Canada, Japan, France, the UK, and the US) that aims to establish a resilient uranium supply market free from Russian influence ‘and the potential to be subject to political leverage by other countries’. It announced plans at COP28 to jointly invest at least $4.2 billion to boost enrichment and conversion capacity over the next three years.

Meanwhile, there are efforts in the US Congress to formally ban all Russian uranium imports by 2028. One sticking point of such efforts has been HALEU (high-assay low-enriched uranium), which is enriched with uranium-235 to between 5% and 20%. ‘Until the Russian invasion of Ukraine, Russia was the only place with a plant licensed to produce material above 5% enrichment,’ says Bunn. The UK’s Civil Nuclear Roadmap, announced on 11 January, promises up to £300 million of investment specifically to develop HALEU fuel production, ‘with the first plant aiming to be operational early in the next decade’.

Advanced reactors, including in the US, are being developed to run on such fuel. These reactors would be ‘smaller, more flexible and less expensive to build and operate,’ according to the US Department of Energy. In the US, Centrus Energy says it is pioneering HALEU to power existing and future reactors. Bunn says the company is well positioned now to seek additional subsidies from the US government to expand its enrichment capacity.

Slow and expensive

Yet despite the drive to reduce carbon emissions, nuclear has been languishing in the doldrums. The adoption of small HALEU reactors has, if anything, slowed. The first company with approval, NuScale, cancelled a power plant for Utah in November after costs surged. ‘Costs have kept growing for small modular reactors,’ says Bunn. Solar, wind and natural gas are really, really cheap right now. That’s nuclear’s biggest problem – it’s expensive.’

Others too say that renewables are outmuscling nuclear. ‘Renewables provided something like 90% of all new electricity capacity [in 2023], and that’s because of the very great difference in cost,’ says Paul Dorfman, chair of the nonprofit Nuclear Consulting Group and visiting fellow at the University of Sussex, UK. ‘And in the context of climate change, nuclear plants take too long.’ He cites UK government findings that it takes up to 17 years for a nuclear reactor to be readied for operation.

A 2021 report authored by Dorfman also warns of the risk sea level rises and storm surges pose to nuclear power plants at coastal sites. ‘The most recent Intergovernmental Panel on Climate Change report [2023] stated that renewables were ten times better than nuclear at CO2 mitigation,’ Dorfman adds. ‘It is clear renewables will do the heavy lifting and nuclear is marginal, if not problematic.’

In the decade before the Fukushima nuclear incident in Japan in March 2011, on average about 3GW of nuclear power generation was being added each year. To meet the COP28 target, factoring in how long it will take to build the plants, ‘we’d have to build on the order of 30-50GW every year from now to 2050,’ says Bunn. ‘That means convincing people that nuclear energy is ten times more attractive than it was before Fukushima. That’s a heavy lift.’

No comments yet