Several big firms have rolled back their targets, saying governments need to set pace with policy

Almost a decade on from the Paris agreement, made by governments around the world to restrain global warming, the world’s largest oil and gas companies have still not aligned to its goal.

Despite a plethora of ‘net zero’ targets, companies continue to pursue new extraction projects. Few companies are planning to reduce production, according to the latest assessment from Carbon Tracker, a financial think tank focused on the energy transition. Indeed, progress on reducing emissions has stalled or even gone into reverse.

Its findings add to the picture of an industry that – in the words of the World Benchmarking Alliance (WBA) – does not have a credible transition plan. That matters because of the sheer scale of its emissions – oil and gas operations account for 15% of global energy-related emissions, while the use of oil and gas adds another 40%.

Shell was back in court in the Netherlands earlier this month to appeal a 2021 ruling that it should cut carbon emissions by 45% by 2030. The order included emissions from the use of its products (categorised as scope 3) that account for the bulk of emissions. While Shell once said it would rise to the challenge of the court ruling, it’s now downgraded its climate goals, including abandoning a 2035 reduction target.

It did introduce a new ‘ambition’, to reduce its scope 3 emissions from oil products such as petrol and jet fuel, by 15–20% by 2030 (from a 2021 baseline). Maeve O’Connor, an analyst at Carbon Tracker and report author, notes that at the same time, ‘Shell intends to focus more on expanding its gas portfolio, so a scope 3 emissions target that’s only covering its oil is going to omit a lot of the emissions it is responsible for’.

In our opinion, the oil and gas companies simply don’t believe the transition will happen

Luis Costa, World Benchmarking Alliance

Shell joins the ranks of companies with net zero targets but no visible pathway to get from 2030 to 2050, and all of whom claim to be leading the charge to build a low carbon energy system. They say it’s for governments and product users to act.

‘In our opinion, it means that the oil and gas companies are simply not believing the transition will happen,’ says Luis Costa, climate research lead at the WBA. ‘Society needs to change, but society includes companies as well and …just a handful of them hold a hugely disproportional amount of emissions. You are accountable to give the steps, to commit to that and to start reducing your emissions.’ Of course, he adds ‘this will have repercussions for other sectors. But that’s why [oil and gas companies] should also engage with them’.

ExxonMobil’s chief executive Darren Woods recently acknowledged ‘we’re not on the path to 2050.’ He said society has waited too long to develop solutions and needs to put a value on decarbonisation. Governments, he added, should introduce carbon taxes or regulate the carbon intensity of products.

Production increasing

Emissions reduction targets tell just one aspect of the story. Carbon Tracker gives more weight to whether companies are aligning investment options and production plans. Both ENI and TotalEnergies, which topped an assessment last year, are found not to be aligned with the Paris goals owing to newly sanctioned projects that fall outside what would be acceptable even in a slow transition. Total is skewing its fossil output towards liquefied natural gas (LNG), which it says has ‘enabled’ emissions reductions of 70 million tonnes in both 2022 and 2023, for its customers (by replacing coal and oil use). At the same time as reducing the emissions intensity of its gas, it aims to sell more.

But demand for oil and gas is still growing, says Tom Ellacott, senior vice president of corporate research at Wood Mackenzie. ‘The war in Ukraine has obviously had an impact on the supply–demand dynamics,’ but he suggests it’s overrated as a factor in the decision of companies to dial back on their climate targets.

The biggest growth in demand is coming from Asia, and while many companies are signing deals in Africa (including ENI and Total), the continent is starting from a much lower base, he adds. In the near term, at least, he doesn’t expect to see many more companies announcing scope 3 emissions targets.

‘In the context of climate change, [cutting methane is] one of the cheapest things you can do

Jonathan Banks, Clean Air Task Force

O’Connor notes a big focus on LNG after the invasion of Ukraine, but so much so that a glut is now forecast towards the latter half of the decade. This is because the transition is advancing, with pledges at the COP28 climate meeting in Dubai in 2023 to grow renewables capacity three-fold and to double improvements in energy efficiency from 2% to 4% between now and 2030, to displace fossil fuels.

Surging energy prices after Russia’s invasion of Ukraine brought oil companies bumper profits, but they have not chosen to spend those earnings on the transition, preferring to increase production. However, a far greater proportion than historically has been spent on returning money to shareholders through share buybacks and dividends, says O’Connor. ‘The logical question is: if the industry is so sure of its future and if it’s so sure that there’s going to be demand for oil and gas way out into the future, then why not spend that money on expanding production even more, now? I think it’s a good indication that the industry is starting to recognise that, at least to some extent, the writing’s on the wall for [its] products.’

Plugging methane leaks

Tackling scope 1 and 2 emissions – from operations and the energy used to power them – and amounting to around 5 billion tonnes of carbon dioxide (equivalent) is, says the International Energy Agency, one of the most viable and low-cost options for rapidly reducing the industry’s emissions.

The quickest and most effective comes from reducing methane, by cutting non-emergency flaring and reducing venting and leaks. This is because although it’s 84 times as warming as CO2, methane has a relatively short lifespan. Alone it is responsible for almost a quarter of post-industrial warming.

Despite a wide variety of pledges to cut emissions, they appear to be still rising. Jonathan Banks, who leads international efforts by the Clean Air Task Force to cut methane, suggests this is in part because the science and technology to measure them is advancing – exposing their true scale.

For example, BP reports methane emissions from its operations as a percentage of the total gas it sends to market. In 2023 this was recorded as 0.05% – well below a 0.2% industry target. However, it’s introduced a new measurement approach to get more accurate data, and from that baseline plans a 50% reduction in emissions intensity. It’s not clear what that intensity target will mean in terms of absolute emissions. To reach net zero requires a 75% reduction in methane emissions by 2030.

We can use the power of the market to reduce emissions on a global scale

Jonathan Banks, Clean Air Task Force

‘In the context of climate change, [cutting methane is] one of the cheapest things you can do,’ says Banks. And in most cases, it’s profitable, although there can be barriers inside companies. ‘I think we’ve got enough momentum on regulations, we’ve got enough momentum on economic policies, on company interest in this … to reach a turning point.’

Earlier this month the European Parliament signed the EU’s methane regulation, which sets a timetable of obligations on methane intensity reporting and culminates in penalties for imports above a threshold from 2030. ‘Because they import gas from so many places – if that’s done properly, the potential impact is enormous. We can use the power of the market to reduce emissions on a global scale,’ Banks adds. In the US, a new methane regulation targeted at existing and new oil and gas wells is yet to be implemented, while a methane fee on emissions above a threshold is expected to be levied from 2025.

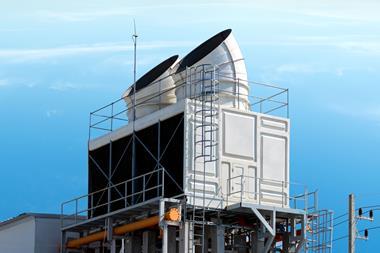

Other measures to reduce scope 1 and 2 emissions involve electrification of facilities, using carbon capture and storage (CCS) technology on oil and gas processes, and expanding the use of green hydrogen in refineries. But the WBA finds companies aren’t investing a great enough share of their R&D and capital expenditure budgets to drive the scale-up of these solutions.

Promise of ‘net zero oil’

Occidental (now rebranded as Oxy) is placing a big bet on recycling and storing carbon acquired via CCS or direct air capture (DAC). By 2032 it aims to ‘facilitate’ 25 million tonnes of carbon dioxide storage or use in its value chain (scope 3) emissions. The firm’s total scope 3 emissions were around 217 million tonnes in 2022, down 16% from 2019.

A first DAC facility is designed to capture 500,000 tonnes of carbon dioxide when it comes on stream next year. Other plants are being explored and it’s developing a 30 million tonne sequestration hub. A spokesperson says its expertise in the field meant it ‘could ultimately produce net-zero oil to meet the continuing demand for liquid fuels and hydrocarbon feedstocks in 2050 and beyond.’ They add that ‘a key part of our strategy is to establish a supply of lower-carbon oil and gas to meet this need with a decarbonised product.’

It’s not clear how much carbon dioxide Oxy eventually anticipates sequestering or reusing. For now, it’s using carbon dioxide from natural reservoirs to boost the output of wells (enhanced oil recovery) but to cover the carbon footprint of its products the source in future would have to be via direct air capture. At present this is hugely expensive and energy intensive. And despite this stated ambition, in 2023 it was spending seven times more on developing conventional oil and gas assets than on low-carbon ventures.

Ironically, oil and gas companies cite climate change as a risk to their future operations. That means perhaps insurers – without whom projects can’t go ahead – can push the pace. Earlier this month, one of the world’s largest fossil insurers, Zurich, said it would stop underwriting new projects and would ask its oil and gas clients to set credible strategies for net zero.

No comments yet