Lionel Milgrom describes his personal experience of two years in the life of a biotech spin-out company.

Lionel Milgrom describes his personal experience of two years in the life of a biotech spin-out company.

Fuelled by visions of financial independence from central government, universities are cashing in on their academics’ intellectual collateral as they rush headlong to form successful spin-out companies. At London’s Imperial College (IC), spin-outs are proliferating at the rate of one a month.

With its first class teaching and research, a thriving business school and thrusting enterprise culture, IC is arguably better equipped than most British academic institutions for the dizzy life of spin-out formation, and is busy inserting entrepreneurial ideas into many of its undergraduate courses. So forming and maintaining a spin-out company in such an environment should be a walk in Hyde Park, right? If only it were that simple. As an academic with no previous business experience, in July 2001 I was launched uncertainly on the entrepreneurial path to corporate captaincy, running an IC spin-out company called PhotoBiotics.

It all started over two years ago. A chance meeting; an old idea rekindled; industrial funding suddenly drying up; and imbibing IC’s heady entrepreneurial spirit all conspired to convince four of us where our financial destinies lay. ’Sure!’ said IC Innovations (IC’s spin-out forming arm), ’Here’s ?25,000: go away, write a business plan, and then see if you can convince the University Seed Challenge Fund (USCF) to stump up another few hundred grand to get you started...’.

Great! But what’s a business plan? So we spent the ?25,000 doing some proof of principle and hiring a biotech business person to help write the plan. This proved a wise use of funds because, by playing devil’s advocate, our ghost-writer made us realise our strengths and weaknesses. By the time the plan was done and dusted, we had a solid case to present to the USCF.

Meanwhile, IC Innovations had been arranging events for budding entrepreneurs like us to ’network’ with the great and the good in the investment community. At one of these, we met someone who later turned out to be our fairy godfather - well, business angel, actually.

The big day came to present to the USCF. Suited and booted, we watched helplessly as our world-beating Powerpoint presentation repeatedly crashed. Panicking, we made for the photocopier...it jammed! At which point, we gave up on hi-tech and resorted to talk, chalk, and hand waving. Somehow, it worked but the USCF board decided we needed more money than they could provide: they would cough up the readies, only if we could find matching funding. Enter our business angel we’d met while networking. Within three days of the USCF decision, he had promised the other half, and our company was almost ready to fly.

I say ’almost’ because funding alone does not a company make. Articles of Association and a Shareholders’ Agreement had to be drawn up and agreed between the various parties. Routine stuff I suppose, but a real pain in the posterior when you’re raring to turn your cherished scientific ideas into biotechnological reality. Two months later, everybody was ready to sign up and our company was officially born.

But the red tape wasn’t over yet. The company’s various operating structures - bank accounts, insurances, accountancy services (so that salaries, taxes, and National Insurance could be paid), boards and board reporting procedures, contracts of employment, and contracts with IC etc - needed to be put in place.

For someone who has spent his academic life engaged in research (and studiously avoiding all admin), there were many times during this early phase when I wished I had never started the whole enterprise. Without enough funding for trained secretarial staff, I had also to take on the role of company scribe, adding to the world’s environmental problems by producing copious papers for board meetings and taking interminable pages of minutes. And then there was the science.

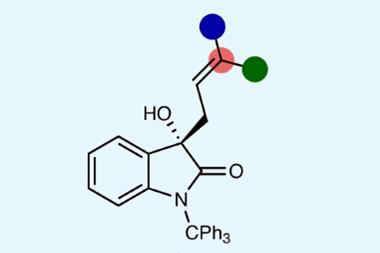

PhotoBiotics’ particular stock-in-trade is a new type of cancer therapy involving a complex melange of chemistry, biochemistry and physics. It looks great on paper and works brilliantly, but took a little time to iron out; in business speak, significant milestones had not been hit on time.

Now, if the science had been supported by a nice, fat BBSRC grant, our progress would have been hailed as a breakthrough. Unlike academic science, we also had to carve out and protect our new technology; something many spin-out companies take for granted before they even start. And being biotech, our perceived success crucially depends on the outcomes of in vitro and in vivo trials. Inwardly adjusting to this change from academic to business criteria was (and still is) for me difficult. And, as luck would have it, the company ran out of funds just before a full programme of in vivo trials could be implemented. The full horror of university spin-out company life then finally hit home.

Even though we attracted plaudits and publicity for our business (we won the first ever Hewlett-Packard New Ventures Competition against a strong field of 20 other European spin-outs), with war looming, and stock markets falling, investors turned and ran, biotech not being their most-favoured investment option: we’d picked the worst possible time to go looking for further funding. Two or three years previously and with the results we now have, they would have been queuing to shower us with cash.

So what have I learnt from this exercise? First, investors, as a whole, are little better than sheep which, like any herd, show bravery in good times and cowardice in bad. Most (but not all) have little real understanding of, or sympathy for biotechnology - just as long as they think it can make money.

Bob Dylan put it brilliantly: ’Business men they drink my wine, ploughmen dig my earth. Not many there among them know what any of it is worth’.

I have also learnt that early-stage university spin-out companies are not acorns to be scattered as promiscuously as squirrel-feed. When the going gets tough, universities must nurture their ’children’ if only to protect their investment.

Finally, the days of the cloistered academic are numbered. As Max Perutz once said: ’Science is not a quiet life’. But even he couldn’t have realised just how noisy and unsettling it is to try to combine the relative tranquility of the research lab with the clamour of the market place. Nevertheless, scientists and technologists need to engage with these problems as a matter of urgency. For if we don’t, there will soon be no high-tech companies for the investment community to make money out of. The present dip in the market will seem like a mere dent compared with the abyss into which it will then sink.

Source: Chemistry in Britain

Acknowledgements

Lionel Milgrom is a porphyrin chemist and freelance science writer.

Update Since the time of writing, PhotoBiotics has acquired bridging funding to keep it going until it finds further funds. |

A positive spin - results of an RSC survey

Growing numbers of spin-out companies may be testament to the high quality of applied R&D work going on in university science and engineering departments around the UK. According to the results of a recent survey by the RSC, chemistry (often jointly with other disciplines) appears to be fairly represented among these high technology start-ups.

Of the 11 universities included in the RSC survey, chemistry accounts for 29 of a total of 225 spin outs arising from research by their academic staff. Some universities, however, appear to be better at fostering this type of activity than others. Research generated by three of the ’most active’ chemistry departments in this respect accounts for 26 of a total of 117 spin-outs from these universities. So what then are the factors encouraging or inhibiting spin out activity?

This was one of the questions that the RSC sought to find answers to by drawing on the experiences of some of those individuals involved. Universities in its survey included Oxford, Cambridge, Bristol, Cardiff, Durham, Imperial College, London, Kings College London, Leeds, Sheffield, Strathclyde and UMIST, and findings are based on the responses to a short questionnaire by university technology transfer officers, heads of chemistry departments and individuals who have started spin-outs.

Other key aims were to characterise spin-out companies from these universities and to compare and benchmark chemistry spin-outs with those from other disciplines. The results of the survey are now available in a report from the RSC and on its website (see end for details).

Apart from the strength of the technology, and the researcher’s enthusiasm to exploit this, several other factors appear to be important in encouraging spin-outs, the survey found. Flexible working arrangements and early financial help to allow academics time out to start up such companies, together with the support of the department head, were identified among the main factors influencing numbers of spin-outs. Role models and mentors, as well as other precedents of success within the university or department are also deemed to be helpful.

Among the factors inhibiting spin-outs, the survey respondents also referred to pressure of work ’in the day job’ and lack of experience. Several commented on the potentially detrimental impact on teaching and research activities owing to the hugely time-consuming business of starting up a company. Attracting experienced management staff for these start-ups is also seen as a problem in many cases, with equity stakes ’essential to attract and retain the best candidates’, according to the report.

Based on the survey findings, the report also proposes various changes in funding mechanisms and arrangements likely to promote spin-outs. Additional funding should also be made available for secondments for academics to found and grow their companies, the report recommends. It also proposes creating regional venture capital funds of ?1-2m with which to grow spin-outs, and suggests that local authorities should allow longer rent and rate rebates to support their growth.

Survey respondents agreed that the RSC may be instrumental in supporting spin-outs through networking activities to share best practice and to introduce individuals to potential partners, CEOs, non-executive directors and funding opportunities. Future RSC activities recommended by the survey may include:

- Publicising successful spin-outs and role models to a wider audience;

- Establishing networks of RSC members who have successfully started small companies and are willing to act as mentors for budding entrepreneurs;

- Bringing together local/regional groups of people running companies for informal meetings so that they can share their experiences; and

- Establishing prizes for entrepreneurial activity by chemistry related spin-outs.

The spin-out companies included in the survey employ a total of 362 staff, of whom 110 are chemists.

Cath O’Driscoll

Links

Industry and Technology Division

The Division is concerned with supporting the scientific, technological and managerial application of chemical science across industry and commerce.

No comments yet