Phenomenal growth rates for organic LEDs are leading to a baroque web of alliances as suppliers hedge their bets between different technologies.

Phenomenal growth rates for organic LEDs are leading to a baroque web of alliances as suppliers hedge their bets between different technologies, reports Richard Stevenson

A market that is projected to grow by a factor of more than 150 over the next three years is certain to attract a lot of interest among suppliers. That is the current story of organic light-emitting diodes (OLEDs), the technology that is expected to take over from liquid crystal displays (LCDs) for many applications in electronic equipment. Initially, OLEDs are being used in mobile phone and personal digital assistant (PDA) displays, but suppliers hope to use them for full-size TV and PC screens.

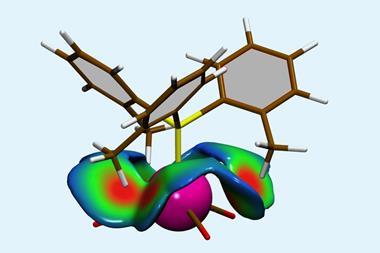

Conventional LCDs suffer from limited visibility, having a narrow viewing angle and, unless they are back-lit, they are hard to see in any but ideal lighting. Light-emitting organic molecules and polymers can be used to get round these problems. By eliminating the backlight needed with LCDs, OLED displays are easier to make and require less power. The screens can be printed using inkjet technology and other straightforward techniques, which should result i in flexible displays including all-plastic circuits and transistors.

Many chemical manufacturers could make the materials, but most of the technology is proprietary, so strategic collaborations to gain access to technology are the name of the game for manufacturers aiming to cash in on this field. This has led to a complex web of cross-licences, made more complicated by the fact that no-one is certain which of the available technologies will prevail. The result is that chemical majors are hedging their bets, trying to keep a foot in each camp, and warily collaborating with potential rivals. Some have identified potentially lucrative markets in making other parts of the package, such as dyes, emitters, substrates and barrier films, as well as or instead of the OLED materials.

Spread betting

Leading technology owners include Cambridge Display Technology (CDT), founded by Richard Friend and colleagues at Cambridge University; Uniax, set up by Nobel laureate Alan Heeger; and Kodak, using in-house technology developed by Ching Tang; while the Japanese petrochemical firm Idemitsu Kosan is also developing in-house technology. Several companies are spreading their bets: DuPont bought Uniax in 2000, but maintains strategic collaborations with CDT.

Late last year, CDT itself bought the UK operations of Oxford-based Opsys, including the intellectual property (IP) rights to Opsys’s dendrimer-based OLEDs. Opsys in California will remain independent, with access to the dendrimer technology. David Fyfe, CEO of CDT, said that the deal was ’in line with our strategy of consolidating IP in the OLED space’.

Supply chains

Other chemical companies see themselves primarily as suppliers of ingredients for OLEDs. Dow Chemical is making polyfluorene copolymer films, while BASF is developing the dyes used as emitters, and will be supplying them to the device manufacturer tecoOptronics of Taiwan.

Covion Organic Semiconductors, an Avecia subsidiary based in Frankfurt, Germany, says that ’its prime focus is as a manufacturing partner to industry innovators’. Covion claims to have been the first company to offer OLED materials on a commercial scale, and to be the only supplier of both small molecule and polymer OLEDs (polyOLEDS).

Nonetheless, manufacturers still need to be linked to the technology leaders. Covion recently signed an R&D memorandum of understanding with Taiwan’s Industrial Technology Research Institute. At the beginning of last year Covion also signed an agreement with CDT giving the two companies access to each other’s innovations in polyOLEDs, with Covion supplying material to CDT’s display device manufacturing line at Godmanchester, near Cambridge. Covion also supplies Philips BU PolyLED, which claims to have been the first commercial supplier of polyOLED-based devices from its plant in Heerlen in The Netherlands.

RiTEK in Taiwan was the second company to commercialise passive OLED displays. Its RiTdisplays spin-off, in which DuPont has a stake, has two production lines already and expects to open two more by 2005, capable of building panels up to 680mm x 880mm. RiT displays is using licensed CDT and DuPont technology and its products will be marketed by DuPont Displays. RiTdisplays expects full-scale commercial production of full-colour displays by the end of next year.

DuPont’s Uniax is also ramping up production in Santa Barbara, California, US, while German firm Osram Opto Semiconductors, a joint venture between Osram and Infineon, is building a production plant in Malaysia using technology licensed in from Uniax.

In a further elaboration of this already baroque web of alliances, Kodak has licensed its OLED technology to other OLED pioneers, such as RiTEK and teco of Taiwan, and Opsys of the UK, as well as a large number of device manufacturers, including such giants as Sanyo and TDK of Japan.

But practical display devices need more than just the OLED material: DuPont Displays has an agreement with Vitex Systems, a start-up firm making plastic substrates for electronic devices. The ’sandwich’ making up a flat panel display needs to be oxygen- and water-tight, which requires barrier films. The DuPont Teijin Films joint venture will be supplying high performance polyesters for the DuPont collaboration with Vitex. Meanwhile, DuPont Displays has recently bought Polar Vision, a Californian maker of polarising films - originally for sunglasses - that has expertise in the filters and lamination technology needed for flat panel displays.

Disruptive markets

The scientists behind CDT recently won the MacRobert award from the UK’s Royal Academy of Engineering for pioneering what the judges called ’a potentially disruptive technology that could replace both the cathode ray tube and liquid crystal displays’. This disruptive technology could soon be worth billions. According to Covion, the opto-electronic industry as a whole is growing at about 30 per cent pa, with Taiwan a centre for device technology and manufacturing. The world market for display devices using OLEDs is currently under $100m (ca ?65m) pa, according to Covion, but is expected to grow to more than $2500m by 2007.

Last year, Frost & Sullivan, a market research firm, estimated that the current market for the OLED materials themselves is just $3m pa, but expected it to grow to $500m by 2005.

Technology advances

OLEDs should soon be moving beyond small displays for PDAs and mobile phones. The Japanese government recently formed a ?5000m (ca ?25m) consortium of 12 companies and four universities to develop 60-inch (150cm) TV screens using OLED technology, and also paper-thin displays that can be rolled up. At the same time, LCD technology is still advancing, with researchers developing new ways to pattern the substrates (eg Chem, Br., September 2002, p18) and to create the wires, electrodes and connectors that underlie the liquid crystal layer. However, some of these generic techniques may be equally applicable to OLEDs as well, so we can expect to see further competition between the two technologies.

Source: Chemistry in Britain

No comments yet