The name Vioxx has become synonymous with disaster in the pharmaceutical industry. What lessons have been learned?

The name Vioxx has become synonymous with disaster in the pharmaceutical industry. What lessons have been learned?

It can take a decade and cost around $1 billion (?475 million) to bring a new drug to the market, and only about a third of drugs will ever cover their development costs. Even when it has reached the market, there is no guarantee that a drug will stay there. It may look very safe in the few thousand patients enrolled in late stage clinical trials, but once it is used by many thousands - or even millions - of people, rare but significant side-effects can emerge. And adverse effects, even in a tiny number of people, can lead to a drug being withdrawn.

When the safety of a multi-billion selling blockbuster is questioned, the financial sting from loss of future sales can be very painful. And the company has the additional prospect of potential legal action.

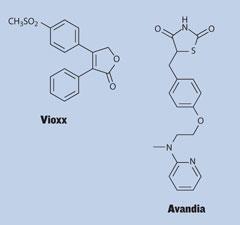

It’s a lesson that has been learned the hard way by US pharmaceutical giant, Merck. Its osteoarthritis drug Vioxx (rofecoxib) was developed to treat inflammation and pain, while avoiding the serious gastrointestinal side-effects that commonly occur with older non-steroidal antiinflammatory drugs (NSAIDs), such as ibuprofen, naproxen and diclofenac. Since its launch in 1999, it is estimated that more than 80 million people worldwide have taken it at some time. But in September 2004, the company withdrew the drug from the market.

It had become clear that Vioxx increased the risk of heart attack in some patients, and Merck was accused of hiding some of the side-effects it had seen in trials. The company maintains that it is not at fault, but its recent and unexpected announcement that it will pay almost $5 billion to settle remaining Vioxx lawsuits shows the scale of this pharmaceutical disaster.

What went wrong?

At the beginning of 1999, Merck began a long-term study, called Vioxx Gastrointestinal Outcomes Research, or Vigor. Its aim was to show that Vioxx avoided gastrointestinal side-effects long suffered by patients who depended on anti-inflammatory drugs for pain relief. The initial results were positive - the Vioxx group had fewer bleeds and ulcers than those who had been taking the older drug naproxen.

But Merck also found that the risk of death and serious coronary side-effects was about twice as high - 79 out of the 4000 on Vioxx were affected, compared to 41 in the naproxen group. The company decided to continue the study, the justification being that naproxen might have a protective effect, in a similar way to aspirin.

The study was published in the New England Journal of Medicine (NEJM) in May 2000, but three of the 20 heart attacks were omitted. Merck later said this was because they happened after the trial’s cut-off date. Full data, including all the heart attacks, were published on the US Food and Drug Administration’s (FDA’s) website, and a meta-analysis using all of these data was published that August in the Journal of the American Medical Association by a group of cardiologists. This cast doubt on the theory that naproxen was having a protective effect, and over the following three years, epidemiological studies appeared to show that Vioxx increased the risk of heart attack and stroke.

The final straw came for Vioxx when a separate study, being carried out to look at its potential in preventing colon polyps, showed that it increased the risk of heart attack in patients who had taken it for 18 months. A further independent meta-analysis published in the Lancet in December 2004 looked at the data available up until the withdrawal to see if the evidence that the drug should have been withdrawn was available earlier. The authors believed it was. ’Our findings indicated that rofecoxib should have been withdrawn several years earlier,’ they reported, adding that they also believed patients were at risk after just a few months, not 18 as Merck claimed.

Trying times

This marked the start of a flood of litigation in the US, with large numbers of people who had been taking the drug making claims against Merck. The first win for a claimant - Carol Ernst, the widow of a man who had died in Texas - was highly publicised, but the company went on to win four out of five cases in the federal courts, and seven out of 11 state trials. According to Merck, a further 5000 cases were dismissed before reaching court.

As Julian Acratopulo, head of the product liability group at law firm Clifford Chance, puts it, Merck ’drew a line in the sand’, proclaiming that it would fight each individual case. But, on 9 November 2007, the Vioxx story took a dramatic turn as Merck finally announced a settlement - a figure of $4.85 billion was allocated to settle ’the majority’ of almost 27,000 pending lawsuits in the US.

Many high-profile product liability cases in the US start as class actions, where a single case is brought on behalf of many claimants. But the US courts have refused to allow a class action for Vioxx - agreeing with Merck that the facts for each individual case are different. Merck reached its settlement agreement with the law firms representing plaintiffs across the US, but the company stresses that it is not a class action settlement, and that every claim will still be evaluated individually, before any money is awarded.

’Where there’s a need to consider the facts of each case, that effectively puts the onus onto the individual claimant to establish the causal link between the product and their condition,’ says Acratopulo. ’Merck’s initial approach was to make the claimants do the hard yards of bringing each individual claim and proving their loss.’

But this strategy was absorptive, both in terms of time and money. When the company announced its settlement agreement, Kenneth Frazier, vice-president of global human health at Merck, revealed that the company had already reserved $1.9 billion to fight the claims. ’Without this agreement, the litigation could have gone on for years,’ he said.

Out-of-court settlement is often the conclusion of product liability cases in the US - and Merck’s $4.85 billion outlay will be a less costly approach than defending every case in court. The huge number of claims is a consequence of the country’s legal system. Product liability lawyers have a direct stake in a claim, as their fee is usually a percentage of the ’winnings’. On top of this, a claimant who loses a case is rarely responsible for the other side’s legal fees.

In the UK, the system is different. There are mechanisms for group litigation, but usually the loser pays the winner’s costs and it’s generally very difficult to get legal aid, so the number of group claims is very low.

In an effort to get around this, one group of UK-based claimants had sought to join a Vioxx case in the US, but this application was rejected by the court in New Jersey, which said the English court was more appropriate for their claim. But there is talk of a change in Europe. The European commissioner for consumer protection, Meglena Kuneva, launched a discussion forum at the end of July and, according to Acratopulo, the issue is high on the Commission’s agenda. ’While it’s clear that they don’t want to pursue some of the features of the US model, there is a will to change the current environment where consumer claims are rarely brought,’ he says. Such a scheme could serve to stimulate pharmaceutical product claims.

A product’s marketing authorisation is granted on the basis of a risk-benefit analysis - a drug is never guaranteed to be risk-free and effective, simply because a company has fulfilled its legal duties. ’There’s a mismatch between the regulatory hurdles and the duty of care that exists as a matter of law,’ Acratopulo explains. ’That’s potentially uncomfortable - the public’s expectation is that every product is 100 per cent safe. One solution is to make the regulatory hurdles more difficult to get over. But, of course, the quid pro quo of that is it might have a chilling effect on the development of new products.’

The Cox-2 crisis

Traditional anti-inflammatories such as ibuprofen work by blocking both known types of an enzyme called cyclooxygenase (Cox). But since Cox also has a role in protecting the mucosal layer of the gut, prolonged use of these drugs can cause gastrointestinal problems. Selective Cox-2 inhibitors were developed to limit these side effects. But selectively blocking Cox-2 is now thought to slightly increase the production of enzymes that cause clotting, increasing the risk of associated heart attack and stroke.

Pfizer’s Cox-2 inhibitor Bextra (valdecoxib) was withdrawn from the market at the same time as Vioxx. Pfizer’s other Cox-2 inhibitor Celebrex (celecoxib) remained on the market but now faces legal action from patients. In November, a US federal court ruled that plaintiffs had not presented reliable evidence that Celebrex caused heart attacks or strokes at standard, low dosages, a ruling that will eliminate many of the lawsuits.

Merck’s efforts to revive the drug class were dashed earlier this year when an FDA committee recommended against the approval of the Vioxx replacement Arcoxia (etoricoxib).

And on 19 November, the UK’s Medicines and healthcare products regulatory agency (MHRA) suspended Novartis’ Cox-2 inhibitor Prexige (lumiracoxib) from the market, citing safety concerns about liver damage.

Open trials

A second high profile drug, GlaxoSmithKline’s Type 2 diabetes treatment Avandia (rosiglitazone), has also been in the news because of claims of cardiac side-effects. A meta-analysis of several studies, published in NEJM in May, suggests that it increases cardiovascular risk. Unlike Vioxx, Avandia remains on the market, but last month the FDA added a warning about the potential increased risk for heart attacks to an existing ’black box’ label on the drug’s packaging.

Sales have plummeted in the months following publication of the analysis (in October GSK reported that sales had dropped by 38 per cent on the previous year to ?225 million for the quarter) and a cloud remains over the whole drug class - Takeda’s Actos (pioglitazone) may cause similar problems. But GSK openly published all of the data from clinical trials, leaving them less exposed to legal claims from patients who have suffered side-effects.

But the company has not escaped class action from investors. In contrast to the Vioxx situation, the lead claimant is UK-based. The pension fund Avon is leading a class action being brought in New York, claiming that GSK misled investors about Avandia’s safety. ’There’s a tension between the interests of the consumers of a product and those who have invested in the company,’ says Acratopulo.

Preventing disaster

Ultimately, the answer to the problems that have emerged with Vioxx and Avandia will lie in being better able to predict which patients will react badly to a drug. It’s an issue that has brought pharmaceutical competitors together. Earlier this year seven companies, including GSK, formed the International Severe Adverse Events Consortium to share genetic data about predisposition to some known adverse reactions.

Since it is not yet possible to pre-screen every patient for potential side-effects before a drug is prescribed, more effort is going into careful safety studies to spot signals that flag up potential adverse events much earlier.

’Recently, we have seen more companies initiating observational studies one to two years before approval,’ explains Leanne Larson, vice-president, patient registries, in the lifecycle sciences group at Ireland-based Icon Clinical Research. ’These are both to help them understand the current standard of care, and to develop baseline information about how comparable patients react to different therapies.’

This also allows a company to put in place a plan to look at the drug’s effects in the longer term when they apply for approval, rather than having to develop one from scratch if the regulator asks for it.

According to Larson, companies should gather as much information as possible about their product and about how it’s going to work in a realistic clinical setting. ’What is going to happen in situations where patients have multiple illnesses and are taking multiple medications?’ she says. ’Understanding how a product is going to work in real patients is key to assuring that those patients have access - that it remains on the market.’

It also means that the regulators will be better placed to make decisions about the risks and benefits of a drug.

’If we can spend more time before approval truly understanding the potential risks of a product, even if they appear to be small in the study population, then we can go into the Phase IV studies with more targeted study designs that may help to capture information about problems earlier on,’ says David Provost, vice-president, late phase services at INC Research, a US-based contract research company. ’What sometimes gets lost in the press reports is that the number of people who experience serious side-effects is often very small, whereas the number of patients benefiting from the drug is very much larger. Regulators assess that risk-benefit analysis, and decide whether the benefits outweigh the risks. It’s a matter of putting better tools in place to assess that risk early on, and be ready to face any problems right at the launch.’

Companies are taking this on board, and the number of surveillance studies is increasing. ’Pharmaceutical companies are recognising the need to keep researching their products after approval, and this proactive surveillance is the way to do it - not just passively reacting to reports of adverse events,’ Provost adds. ’If we spot early signs of adverse events, a company can either provide additional education for physicians and patients to prevent the risk, or come up with another strategy to prevent it becoming a problem.’

Patient registries would make it simpler to identify the patients most likely to be adversely affected, and those in which the drug will work best. Ultimately, this could make the difference between a drug being withdrawn and being allowed to remain on the market. ’If we could better define which patients are more appropriate for the product, then we could help ensure that it would remain available to those who would benefit most,’ says Larson. ’The restricted-access registries in place for products like thalidomide, clozaril or isotretinoin are good examples - without these programmes, the products probably wouldn’t be available to patients who really need them.’

In the case of Vioxx, she adds, Merck would likely have benefited from having a patient registry in place. ’Adverse events will happen regardless of whether a registry is in place, so [companies] are much better off having this information sooner rather than later. With information in a structured format, they can go back and look at the situation in an appropriate statistical manner. If a safety signal appears, they’ll have an opportunity to evaluate it and to better understand whether it’s significant. Provost agrees. ’It is far better to get an early signal and react to that to mitigate the risk it identifies than to sit back and hope it doesn’t become a significant issue.’

With the settlement agreement in place, Merck now hopes to go back to the business of developing new drugs. But its own ill-fated blockbuster may have permanently changed the regulatory process for all future products.

Sarah Houlton is a freelance science writer based in London, UK.

Additional reporting by Victoria Gill

A turning point

Steven Nissen from the Cleveland Clinic in Ohio, US, led clinical studies that showed the increased cardiovascular risk associated with both Vioxx and Avandia. He suggests that the Vioxx case was a turning point for drug regulation. ’The FDA has recognised the need to be more vigilant with regard to drug safety,’ he says. ’The thing with Vioxx is that it wasn’t a better pain reliever - the whole point of it was to reduce the gastrointestinal side-effects.’ Although these side-effects were often serious, Nissen maintains that with no compelling benefit, consideration of risk must be at the forefront of drug regulation.

He thinks that public trust in the pharmaceutical industry is at a low point, and has called for an open, public dialogue about the risks and benefits of drugs during the regulatory process. ’We need to be much more careful about what to approve, because once you have let the genie out of the bottle, it’s hard to put it back in,’ he says.

Victoria Gill

No comments yet