A $2bn deal with Almirall and a raft of acquisitions and partnership deals bulk up two focus areas for the company

AstraZeneca (AZ) has agreed to buy Spanish firm Almirall’s respiratory drug assets for $875 million (£518 million) up front, plus up to $1.2 billion in performance milestone payments. The deal is the biggest in a suite of acquisitions and partnerships the company has negotiated since its run-in with Pfizer in May, aimed at topping up its pipeline and making the company a more attractive prospect for investors in the short and long term.

In this deal, the Anglo-Swedish pharma major will take control of several compounds at varying stages of development. These include the recently-approved chronic obstructive pulmonary disease (COPD) drug Eklira (aclidinium), as well as a combination of Eklira with formoterol, which has been filed for approval in the EU. It also includes several programmes in earlier clinical and pre-clinical development, along with Almirall’s subsidiary that develops inhalers for delivering the drugs.

The deal builds on AZ’s acquisition of respiratory specialist Pearl therapeutics last year, and a licensing deal with UK start-up Synairgen covering an experimental inhaled interferon treatment to treat asthma sufferers who are prone to viral respiratory infections.

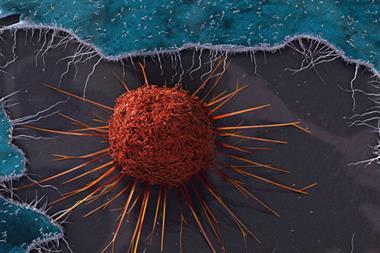

Another area that AZ is pushing hard into is immuno-oncology – harnessing the immune system to fight cancer. The company has signed two partnership deals with Roche and Qiagen to develop diagnostic tests to identify suitable patients for its non-small cell lung cancer drug Iressa (gefitinib) and a follow-up drug in clinical trials. AZ’s biological drugs arm, MedImmune, has also signed up with Advaxis in the US and Kyowa Hakko Kirin of South Korea to run clinical trials on combinations of its anti-programmed death-ligand 1 (PD-L1) antibody with antibody drugs the other two companies are developing.

No comments yet