Plans to develop the world’s largest vegetable oil refinery reveal diverging views on the sustainability, profitability and scale of plant-based supply chains, finds Andy Extance

To get a glimpse of Randy Delbert Letang’s vision for sustainable future fuels, you must first seek the idea that grew on his grandparents’ farm in the Caribbean. ‘They sent me off to school to get an education, but I can tell you I’m not interested in going to be a farmer, especially when you’re paying hundreds of thousands of dollars in college fees,’ he says. Instead, Letang is president and chief executive of SGP Bioenergy, which is building the first biorefinery on the scale of a conventional oil refinery.

Biorefineries are facilities that convert natural materials to fuels or chemicals. SGP Bioenergy’s one will repurpose existing bunker fuel oil terminals together with new facilities at opposite ends of the Panama Canal, in Colon and Balboa, eventually producing 180,000 barrels (29 million litres) of biofuel per day. It will buy crops grown by farmers under contract, requiring 1.5 million acres (0.6 million hectares) of land, Letang estimates (for reference, there are about 23 million acres of farmland in the UK). He argues that farms like his family’s are getting progressively less profitable, so ‘farming for bioenergy can be a stepping stone’ to improving agriculture’s financial future. Letang declined to disclose the crop that SGP Bioenergy is contracting farmers to grow but says that it returns as many nutrients from the soil as it withdraws.

We do not have enough sustainable biomass to decarbonise every sector

SGP Bioenergy has now raised the investment it needs for the biorefinery’s first phase, which will use vegetable oil to produce 60,000 barrels of biofuel per day, along with some additional products. Contractors are due to start clearing and levelling its construction sites this year. Even at this reduced level, the Panama project is huge by typical biorefinery standards. Yet from another perspective, it’s tiny, Letang notes. At its intended full output, it would supply less than 1% of the projected global demand for renewable liquid fuel in 2050. ‘What that tells me is that we have a lot of work to do,’ he says. Letang hopes that the Panama refinery is the seed of a concept that will grow and spread rapidly. Otherwise, the 2050 net zero greenhouse gas emission target laid out in the Paris Agreement is ‘unattainable’.

Yet Jhuma Sadhukhan from the University of Surrey in Guildford, UK, sees the optimal scope of biorefineries very differently. ‘We do not have enough sustainable biomass to decarbonise every sector,’ Sadhukhan tells Chemistry World. She sees decarbonising the chemical sector using carbon-neutral biomass feedstocks that sequester carbon dioxide as they grow during photosynthesis as a realistic target. In this scenario, biorefineries primarily co-produce energy for their own use, or supply biomass-based energy for poor marginalised communities. There is always competition for how to use land, she notes. She urges care in growing plants specifically to produce fuel or energy.

Sadhukhan and Letang present conflicting visions of what biorefineries are, and what they can do. Yet overall, they and others agree that while the concept is promising, biorefineries face great challenges in doing what we need them to. Letang is right that without scaling them up significantly, they’ll have little impact on the world’s climate goals. Sadhukhan is also right that decisions about where the natural raw materials come from will have a major impact on our environment. Researchers and decision-makers at universities and companies across the world are wrangling with these and many other issues, shaping what biorefineries will become.

Growing demand

Working in a laboratory in a small industrial unit in Surrey, UK, Elham Ketabchi is a great example of a researcher seeking to develop a product using materials from a biorefinery. She’s head of research and development at Vistafolia, a company that makes artificial green walls, realistic-looking fake plants that can decorate large areas of buildings. The plastics used must be resistant to fire, and stable when exposed to ultraviolet light. Ketabchi stands at a white fire testing chamber, measuring the fire resistance of new bio-based formulations of Vistafolia’s products by holding them in a Bunsen burner, as part of a project working with the University of Surrey. After 40 different formulations, she finally finds the right combination of bio-based materials and additives to reduce the amount of smoke produced to the level she needs. Ketabchi calls the moment ‘amazing’. ‘It does actually work if I do use something that’s more sustainable,’ Ketabchi says.

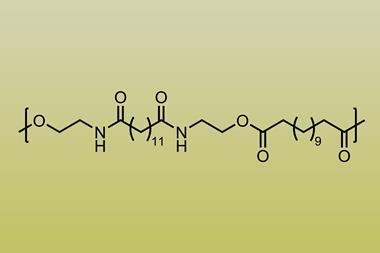

To make Vistafolia’s products UV stable and fire resistant, she needs bio-based versions of the right polymers and additives. The biobased polymer could be derived from organic raw materials like vegetable oils or sugar cane, waste grease, or by-products from the food industry, such as animal fat, Ketabchi says. One key consideration is that the right grades of bio-based substances are required to perform the same way as their fossil-fuel based counterparts. A second important consideration underscores the underlying demand for biorefineries: getting enough of the raw materials. ‘If we don’t have the availability that we need, then it hinders our process,’ Ketabchi stresses.

Biomaterials producer Novamont provides clues to why availability can be such a challenge to users of bio-based chemicals. Founded in 1989 and based in Novara in Italy, Novamont is now ‘a world leader in the production of bioplastics and in the development of biochemicals and bioproducts’, according to Giulia Gregori, the company’s head of corporate strategy implementation and engagement. Beyond biopolymers, Novamont makes bioherbicides, biolubricants and biodegradable ingredients for cosmetics. It has 650 employees, turnover of approximately €414 million, four production plants and three research laboratories. ‘In the last 10 years our turnover has increased by 200% and employment by 80%,’ Gregori says. In April 2023, it was acquired by Versalis, Italy’s largest chemical company, which has a long background in petrochemicals.

That growth and the subsequent acquisition is a measure of the strong demand for Novamont’s products. The EU Biorefinery Outlook to 2030 report, published in 2021, anticipates demand for bio-based products within the EU being higher than supply through to 2030 in both of its future scenarios. The report also notes that at least 60 biorefineries were established before 1980, along with hundreds of more recently established facilities seeking to meet the demand. Overall, compared to the fossil fuel industry, Gregori says that biorefineries are ‘still an emerging sector, which has still not achieved the same technological maturity and is still strongly investing in research and development activities’.

To best harness that demand, Sadhukhan recommends that biorefineries focus on chemical products that can be sold at higher prices than we’re used to paying for energy. That ‘can create an opportunity for livelihood generation for poor marginalised populations’ in countries like Mexico and Brazil, she says. But even in wealthy Europe, specialist products are more appealing, because the market is less willing to pay enough for higher volume commodity chemicals to cover production costs, according to the EU report. In addition, Sadhukhan notes that added-value products account for less than 20% of the weight of the original biomass inputs. Using the remaining 80% to generate the heat and energy needed to run the biorefinery can help improve financial viability, Sadhukhan says.

Going to waste

Sadhukhan also argues that concentrating biorefineries on chemical production is better for the environment. In total there are around 400 biorefineries operating in Europe, with most generating two or more added-value chemicals, Sadhukhan notes. The carbon that biological feedstocks like plants absorb from the atmosphere would be trapped in products like biopolymers for longer than fuels, she explains. ‘Biorefineries are for the betterment of the environment and must not cause ecosystem damage [and] biodiversity loss,’ she adds. The amount of biomass available without causing conflict over or change in land use ‘is quite small’ she says. However, two-thirds of European biorefineries worldwide use first-generation food, Sadhukhan adds. ‘Such systems must be scrutinised for potential damage to the environment and retrofitted for non-food non-consumable excess available biomass,’ she says.

Bioeconomy companies like Novamont are indeed looking to integrate ‘scraps from the agro-industrial value chain’, according to Gregori. Echoing Letang’s plan, they are also working with farmers to promote the use of ‘dryland crops able to grow in marginal land’, as raw materials, she says.

Biomethanol is more expensive to produce than the equivalent fossil fuel

In Äänekoski, Finland, the French utility company Veolia is building a refinery that will use ‘non-food non-consumable excess available biomass’, as Sadhukhan recommends. Yet rather than making added-value chemicals, it’s using waste from Finnish forestry company Metsä Fibre’s pulp mill to produce biomethanol fuel. ‘It will start producing as intended most likely in the second half of next year,’ says Jacob Illeris, business development director at Veolia Northern Europe. Like SGP Bioenergy’s Panama biorefinery it will be the world’s largest example of its type, but in this case the scale is a lot smaller. It will make up to 12,000 tons of biomethanol per year – but because of the type of paper mill, the technology has much greater potential.

The pulp mill uses the kraft process, which chops up wood into chips and heats them in a mixture of water, sodium hydroxide and sodium sulfide, cleaving off methyl groups from woody lignocellulose. The methyl groups become methanol, as part of a ‘black liquor’ that is usually burned to generate heat and electricity, and recover useful inorganic salts. Veolia’s new plant distils out the methanol from contaminants like sulfur, as well as smaller volumes of ethanol and acetone. Four-fifths of paper mills across the world use this process. If all such plants had the kind of biorefinery Veolia is building, they could together produce around 2 million tonnes of carbon-neutral biomethanol per year. That’s impressive, but less than the 9 million tonnes of biofuel per year SGP Bioenergy’s Panama plant intends to produce.

Yet as the EU Biorefinery Outlook to 2030 suggests, making a chemical as readily derived from natural gas as methanol from a biological resource is not directly competitive. To build the biorefinery has involved support from the Finnish Ministry of Economy and Environment of up to €9.4 million (£8.2 million). And to sell the biomethanol Veolia must ‘look downstream at who appreciates the value, because this is more expensive to produce than the equivalent fossil fuel’, Illeris says. ‘We expect to be able to find improvements to the process and the costs that allow us to build commercially viable plants without support,’ he adds.

Not the only solution

Improving economic competitiveness with fossil fuels is why Letang wants to build the Panama biorefinery. He wants to be able to produce fuel without incentives, because not every country can afford them. ‘[If] we reduce the cost to the point where we’re at or slightly above parity with standard fuels, we grant access to the global marketplace for all these fuels,’ he tells Chemistry World. To do this, Letang will primarily use his experience negotiating supply contracts to secure biological feedstocks for energy production. ‘We’re growing these crops, creating recyclable carbon sources as well as restoring usability of, in some cases, inactive farmland, and impacting the local economy,’ he says. ‘As long as you’re responsible, paying attention to how much water you use, and careful not to disrupt food crops and not to create more carbon rather than sequestering it, I don’t see a more viable path to reaching 2050 or even 2030 sustainability goals than we have for biofuels.’

SGP Bioenergy is working with well-established companies to design and construct its biorefinery, such as US-headquartered Fluor. The aim is to use well-established, reliable processes rather than anything innovative. Another partner is Danish company Topsoe, which is supplying facilities that will produce sustainable hydrogen from the biorefinery’s by-products. Topsoe is also supplying process equipment to react the hydrogen with vegetable oil feedstocks to make biofuel. SGP Bioenergy also aims to sell 400,000 tonnes of hydrogen per year as a separate income stream.

There is no single source of feedstock that can replace fossil feedstocks

While Sadhukhan generally disagrees with people like Letang who think that biorefineries should be used to make fuels, she agrees with him that biorefineries should not need subsidies to operate. However, she notes that attracting the €750 million to build a biorefinery with fossil fuel scale production volume of 220,000 tons per year is difficult, ‘which is limiting their scaling potential to compete against large-scale fossil-based industries’. That is a key factor determining why costs of bio-based products are usually higher and supplies less satisfactory.

Illeris is unafraid to recognise these difficulties. ‘There is no single source of feedstock that can replace fossil feedstocks,’ he says. Biorefineries on their own won’t uproot their fossil fuel rivals altogether, he admits, yet he is not deterred. ‘In the bigger scheme of things, it will be a patchwork of different kinds of feedstocks, including renewables, wind, solar and hydroelectric power, which eventually will replace what can be replaced.’

Deploying facilities like Veolia’s in Finland is therefore crucial to sustain the sector’s growth. ‘In order for us to replace fossil fuels to a larger extent, we need many, many actors to engage to start producing renewable fuels at industrial scale, because there’s a learning curve here for everybody,’ Illeris says. ‘We need to identify the feedstocks. We need to know how to process them. There is a whole supply chain based on fossil fuels that needs to be replaced. It will be a long process. Building such a refinery here, it’s a small contribution in the very big scheme of things. But it’s a necessary contribution for us to collectively learn how can we navigate this journey for the sake of the global climate.’

Andy Extance is a science writer based in Exeter, UK

No comments yet