Following the withdrawal of many large pharma companies from central nervous system research, Andy Extance finds new drug development patterns are emerging

Given that glutamate is the brain’s most common neurotransmitter, how can you make a drug that exploits it with minimal unwanted side effects? That’s a question that put Vlad Coric on course to becoming chief executive officer of BioHaven Pharmaceutical when he was studying medicine at nearby Yale University. ‘I saw that when we gave people ketamine, yes, you had antidepressant and other therapeutic effects from modulating glutamate,’ Coric recalls. He was concerned, however, that repeated ketamine use is thought to put people at risk of developing effects similar to psychotic symptoms that limit its therapeutic usefulness.

Despite that concern, a form of ketamine is one of few drugs targeting the brain to receive market approval in recent years. Long used as an anaesthetic, its new incarnation as a patented antidepressant has been made possible by purifying and marketing just the active version of ketamine’s two mirror-image enantiomer forms. The resulting molecule, esketamine, is now marketed as the nasal spray Spravato by Janssen, the drug-making arm of US multinational Johnson & Johnson. Yet its acceptance hasn’t been universal. In January 2020, for example, the UK’s National Institute for Health and Care Excellence (Nice) published draft guidance advising against recommending its use.

Tito Roccia, director of therapeutic area medical affairs at Janssen UK, noted that Nice’s appraisal process is ongoing. ‘Naturally, we are disappointed with the initial outcome but remain determined to ensure patients living with treatment-resistant major depressive disorder are able to access an important new treatment option,’ he says. ‘Esketamine nasal spray offers the first new mechanism of action in 30 years to treat major depressive disorder. We are committed to addressing Nice’s concerns during upcoming stages of the appraisal process.’

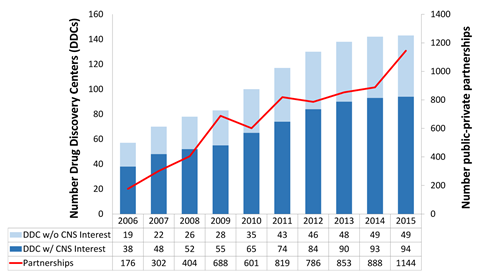

This specific issue comes against a backdrop of a general lack of drug candidates for brain targets. Major pharmaceutical companies have long been downsizing their central nervous system (CNS) research and development programmes. Janssen is a notable exception, investigating 22 new potential drugs for neuropsychiatric and neurodegenerative conditions, with three in mid- to late-stage development. Yet between 2009 and 2014, there was a 52% drop in CNS drug discovery and development programmes pursued by large pharma, with almost all companies showing a decline.1 That situation has continued, despite great unmet needs remaining in mental health and other CNS conditions.

Research and development in psychiatric and neurological disorders is notoriously challenging, Roccia stresses. Issues with recruiting and retaining patients are common in clinical trials in the area, leading to additional costs and delays, he says. Other researchers argue that drug approval processes are not well suited to CNS drug development. Meanwhile, the brain’s complexity and the resulting difficulty in understanding it are fundamental issues that underlie why many large drug companies left the field. But university research centres and smaller firms are stepping in, often teaming up with big pharma. And in doing so they are starting the long process of rebuilding the pipeline of therapies that target the brain.

Looking beyond single receptors

Without doubt, the pharmaceutical industry has been put off by the long, expensive and unsuccessful struggle to develop new drugs to treat Alzheimer’s disease. Their approaches typically relied on drugs that reduce production of β-amyloid protein that forms sticky plaques in sufferer’s brains. And they failed to produce compelling benefits notes Michael Kassiou, medicinal chemist at the University of Sydney in Australia. That’s because we don’t understand CNS biology well enough, he says. ‘We have a reliance on preclinical animal models that don’t recapitulate the human pathology completely,’ he says. ‘When the amyloid mouse model was generated, people thought “We’re going to cure Alzheimer’s disease.” What we’ve done is cure hundreds and thousands of demented mice, but nothing’s translated in the clinic.’

That’s in part down to CNS complexity typified by glutamate, where one substance has many roles. In signalling between neurons, glutamate interacts with at least four different types of receptor proteins. By contrast, conventional small molecule drug discovery often optimises for only one type of protein target. Kassiou says this is so common in the drug discovery process that regulators expect tests that analyse how a single drug interacts with a single target. ‘It doesn’t work,’ Kassiou says. ‘We need to think of CNS disease in this multi-faceted way. You have a broad understanding of the disease biology and need to develop drugs that actually interact with many of these pathways.’

Similarly, in recent years research has focussed on matching the structure of potential drugs with a target protein. Kassiou also advocates stepping away from this.2 ‘The way to develop drugs that are truly going to be disease modifying is a phenotypic approach,’ he says. Studying phenotypes involves looking at observable changes in living organisms. For example, The Salk Institute for Biological Studies in California, US, has developed screening assays that study whether or not nerve cells die.3 These could help develop drugs for diseases linked to neurodegeneration in old age, or stroke. ‘You say, “Am I getting a response I would expect to see from a therapy?” and then go back and work out what the target or targets actually are, which may turn out to be ones that we have not considered.’ Kassiou notes that such approaches are not high throughput. Yet he feels that combined with a multi-target approach they offer ‘the best chance of developing therapies that really work’.

Drug development software and services firm Certara is promoting quantitative systems pharmacology (QSP) for CNS drug development as another approach to tackle brain complexity. ‘Typically, drug discovery projects focus on a single biophysical scale,’ says Piet van der Graaf, head of QSP at Certara’s site in Canterbury, UK. However research models often miss connections between processes at different scales, he explains.4 QSP couples different biophysical scales, scaling up molecular findings ‘to the level of cognitive processes’, van der Graaf says. It quantitatively evaluates mechanisms of responses to therapies, he explains. Certara is actively applying QSP to better understand the mechanism of action for brain diseases. It also promises ‘a more accurate and comprehensive method’ for evaluating drug effects and optimising clinical trial design.

Involving more players

At a molecular scale, van der Graaf has helped integrate pharmacokinetics and pharmacodynamics (PK/PD) modelling with metabolomics to study dopamine antagonist remoxipride. As well as his role at Certara, he is also professor of systems pharmacology at Leiden University in the Netherlands. The Leiden team connected PK/PD modelling with data on how remoxipride broke down into its metabolites in rats measured by ultra-high performance liquid chromatography coupled with tandem mass spectrometry (UPLC-MS/MS).5 ‘The plasma and brain drug exposure profiles are determined by the pharmacokinetics, to drive the binding and activation of potentially multiple targets,’ van der Graaf says. Metabolomics can then evaluate downstream biochemical effects, which ‘underscores the importance and potential of biomarkers in CNS drug development’.

To better understand pharmacological action, multiple levels of such biomarker data need to be collected, van der Graaf says. ‘Eventually, these biomarkers will be linked to physiological measures and clinical outcome during clinical development,’ he says. Success will require detailed biomarker evaluation in many contexts, ‘and the generation of a proof of principle by application to multiple CNS drugs in multiple species’, van der Graaf concludes.

Such complexity means that development times for CNS drugs are significantly longer than in other therapeutic areas, according to neuroscientist Barbara Slusher. She is the director of the drug discovery programme at Johns Hopkins in Baltimore, US, and says that this has driven many big pharma companies to adopt a ‘risk-share strategy’. ‘They’re using more of an open innovation model in which pharma, biotech and academia all work together,’ Slusher explains. ‘Most early drug discovery and development in CNS is carried out in small, targeted biopharmaceutical companies. And many of those are spun out from academic discoveries.’ She notes that funding from venture capitalists is becoming increasingly available for academic drug discovery efforts. ‘I think big pharma is allowing that to play out to proof of concept and then get involved and use their large development engine to advance the projects.’

Slusher leads a dedicated drug discovery team at Johns Hopkins. Teams like hers can collaborate with CNS experts who ‘often spend a lifetime of research in a single disease area or therapeutic target’. Such deep expertise is rarely available in the pharmaceutical industry, she says. And pharma and venture capitalists are recognising this too, providing funding to progress drugs against novel targets. ‘If it’s successful, then the university and the pharma or venture group would initiate a new company and move it forward,’ she explains.

Choosing the right targets

Several internal Alzheimer’s programmes at Johns Hopkins study targets beyond reducing β-amyloid levels. The drug discovery group has also licenced novel CNS drugs to pharma, although they can’t disclose what they are. One partner is Japanese pharma company Eisai, with which Johns Hopkins has a long-term relationship. Slusher and her colleagues identify new drug targets and share them with the drug company. If Eisai is interested in the target, Johns Hopkins researchers develop a high throughput screening assay. Working with Eisai scientists, they can then test whether there are any promising hits in the drug company’s large collection of potential drug molecules. ‘When we do the drug discovery on those hits, if we come up with anything, the company has first rights to it,’ Slusher explains. ‘One of our CNS targets went through this type of high throughput screening and then was licenced to Eisai.’

Roccia notes that partnerships and collaborations are key to Janssen’s efforts to resolve challenging medical conditions, where unmet needs remain high. Through them, the company can ‘harness the best scientific expertise in the world, which allows us to operate more effectively and more efficiently for the benefit of our patients’. One such unmet need comes in patients with insomnia and connected major depressive disorder. Janssen is co-developing a drug called seltorexant for this condition together with Minerva Neurosciences. It targets a brain system only discovered in the late 1990s, involving the neuropeptide orexin. ‘The orexin system in the brain is involved in the control of several key functions, including metabolism, stress response and wakefulness,’ Roccia explains. Seltorexant is an orexin-2 receptor antagonist, whose effectiveness is yet to be confirmed by phase 3 clinical trials, he adds.

Meanwhile, BioHaven Pharmaceuticals exemplifies the role small, targeted biopharmaceutical companies can play. Its migraine treatment rimegepant (Nurtec), approved by the US Food and Drug Administration in February 2020, shows what’s possible when brain biology is well understood, Coric stresses. Levels of calcitonin gene-related peptide (CGRP) are linked to higher migraine incidence, he explains, and four drugs already block the CGRP receptor and relieve migraines. But they are all monoclonal antibodies that must be administered in hospitals. BioHaven has therefore developed a small-molecule drug that people can take as a pill at home.

Finding less risky strategies

Now, BioHaven is seeking similar success targeting glutamate. Having too much is toxic, including in motor neurone disease, obsessive compulsive disorder (OCD) and Alzheimer’s. But it’s the most abundant excitatory neurotransmitter in our brains, needed for normal functioning, Coric explains. It is ‘too important of a neurotransmitter to block it or to increase it – you get problems at either extreme’, he warns. So BioHaven has developed a treatment to increase levels of a transporter protein located on glia cells in the brain. ‘It sucks up glutamate like a vacuum cleaner, brings it into the glia, converts it to glutamine, and it’s no longer neurotoxic,’ Coric says. The same transport process also feeds that glutamine back into glutamate production, keeping glutamate levels steady. ‘Increasing cycling, if glutamate’s too high, it brings it down,’ Coric says. ‘If it’s too low, it increases it, like a thermostat.’ One drug – riluzole – already did this in amyotrophic lateral sclerosis (also known as motor neurone disease). But in pill form it’s absorbed so poorly from people’s guts it requires long fasting periods.

Therefore BioHaven has explored 300 potential prodrug versions of riluzole, modified especially so that people could absorb it from their guts more easily. Once tririluzole, the best of these prodrugs, entered the bloodstream, enzymes broke it back down to riluzole, which then increased glutamate transporter levels. BioHaven is now testing tririluzole in phase 2-3 clinical trials for conditions including Alzheimer’s, OCD, and the degenerative genetic disease spinocerebellar ataxia (SCA). Coric calls this ‘a basket trial approach’ and recommends it as a strategy to successfully develop drugs targeting the brain. ‘We recorded about 10 different disorders that we could study that there was good evidence, preclinical and clinical, that glutamate plays a role and now equally invest in each of these,’ he says. ‘This is in contrast to Alzheimer’s and β-amyloid, where everyone went all in and boom, 15 years and billions of dollars has gone if you lose.’

Slusher stresses that such failures shows that more basic science is needed. Recognising this is leading to ‘major changes in patterns of drug discovery’ for CNS drugs, she adds. These patterns may now be feeding through from groups like hers and targeted smaller firms to the pharma giants. But that may not be obvious any time soon, Slusher says. ‘This is 20, 30 years – this is not short term,’ she underlines.

Andy Extance is a freelance science writer based in Exeter, UK

References

1 B H Yokley, M Hartman and B S Slusher, ACS Chem. Neurosci., 2017, 8, 429 (DOI: 10.1021/acschemneuro.7b00040)

2 J J Danon, T A Reekie and M Kassiou, Trends Chem., 2019, 1, 612 (DOI: 10.1016/j.trechm.2019.04.009)

3 M Prior et al, ACS Chem. Neurosci., 2014, 5, 503 (DOI: 10.1021/cn500051h)

4 H Geerts et al, CPT Pharmacometrics Syst. Pharmacol., 2020, 9, 5 (DOI: 10.1002/psp4.12478)

5 W J van den Brink et al, Eur. J. Pharm. Sci., 2017, 109, 431 (DOI: 10.1016/j.ejps.2017.08.031)

No comments yet