Misconceptions along with a lack of time and resources driving industry’s reluctant attitude to biocatalysis and chemoenzymatic catalysis

Most industrial labs, especially in the pharmaceutical sector, are not routinely using biocatalysis. That is the top take-home message from a survey of senior leaders at fine chemicals companies. It identified a lack of appropriate education at university level and a lack of available infrastructure as the main barriers to companies using biocatalysis and chemoezymatic catalysis.

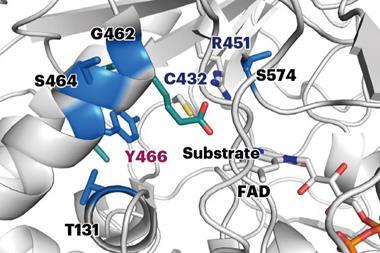

Biocatalysis differs from traditional catalysis in that it uses isolated enzymes, or sometimes whole cells, to initiate, direct and expedite chemical reactions, typically in water. With Frances Arnold scooping a 50% share of the 2018 Nobel prize in chemistry for her work on directed evolution, awareness of how genetic modification can optimise enzymes and create new ones has helped drive the field forward. Moreover, biocatalysis has proven itself to be superior to chemocatalysis in terms of its ability to selectively yield enantiomerically pure molecules using just water as a reaction medium, generating a benign waste-stream. Further developments enabling chemocatalysis to take place in water, mean that chemo- and biocatalytic processes can now be combined in aqueous media and performed in a single reaction vessel. By maximising efficiency and minimising waste both the green and financial benefits of performing such processes in water are widely recognised by members of academic and industrial labs alike.

So why is it taking industry so long to adopt biocatalytic processes? This is what Fabrice Gallou of Novartis Pharma in Switzerland, Harald Gröger of Bielefeld University in Germany and Bruce Lipshutz of the University of California, Santa Barbara in the US set out to uncover.

The trio posed a survey containing three open-ended questions to more than 40 representatives from industry including those working in big pharma, food- and fragrance-based organisations, companies specialising in agrochemicals as well as contract research organisations and contract manufacturing organisations. They guaranteed anonymity to encourage candid answers; 28 people responded.

The survey identified numerous reasons behind industry’s reluctant attitude to biocatalysis and chemoenzymatic catalysis, but awareness, time, costs and resources emerged as overarching themes.

‘I never learned it,’ says Gröger. ‘As a classic organic chemist, I was trained not to use water and I was trained not to use enzymes.’ Biology is not typically part of university curriculums for those specialising in organic chemistry. ‘If people don’t do that at university level, [they] will not bring it into industry,’ Gröger adds.

Strategic and technical limitations included a lack of existing infrastructure, requiring large upfront investments, as well as concerns surrounding performance, the time taken to develop the new processes and incompatibility with existing systems. These barriers are likely to be particularly insurmountable for small or medium-sized enterprises.

‘I also see a cultural aspect,’ comments Gallou. ‘It is very rare to have the two communities [chemocatalysis and biocatalysis] open up to each other about what is happening in their world. They still work exclusively, although they should be working hand in hand.’ Several responses to the survey highlighted the perception that bio- and chemocatalysis remain incompatible because the latter still takes place primarily in organic solvents, rather than water.

Lipshutz was surprised by the results: ‘Let’s face it, we have a field which seems to have fantastic opportunities. We had a Nobel prize in 2018. I was expecting everybody to sort of jump in, and in fact it was quite the opposite.’ And while the field hasn’t expanded as quickly as they imagined it might, Gallou, Gröger and Lipshutz remain optimistic about the opportunities it presents.

E-factor inventor Roger Sheldon, who holds positions at Delft University of Technology in the Netherlands and the University of the Witwatersrand in South Africa, is less surprised by the survey results but similarly optimistic that change is coming. ‘The pharmaceutical and fine chemicals industries are rather slow at picking new things up. Most people today probably don’t realise that, before the 1990s, the pharmaceutical and fine chemicals industry didn’t use catalytic processes. They used very unsatisfactory processes using large amounts of stoichiometric reagents, leading to enormous amounts of waste.’

Sheldon says misconceptions surrounding the high price and limited availability of enzymes is still a concern for those working in industry who aren’t aware of recent advances. ‘With the genomics revolution, you now have many more enzymes available, and with high throughput testing you can very easily find a new enzyme that nobody has ever seen before.’

References

F Gallou, H Gröger and B H Lipshutz, Green Chem., 2023, 25, 6092 (DOI: 10.1039/d3gc01931d)

Additional information

F Gallou, H Gröger and B H Lipshutz, Chem. Rev., 2023, 123, 5262 (DOI: 10.1021/acs.chemrev.2c00416)

No comments yet