Andy Extance discovers why the compound best known as a fertiliser is a surprising candidate to power enormous container ships

In a giant warehouse in Copenhagen, Denmark, sits a 500-tonne engine, each revolution of its crankshaft moving the world nearer a revolution that could clean up international shipping. There, in the research centre of engine designer MAN Energy Solutions, the only clue to that transformation is invisible. MAN provides designs to heavy industry conglomerates, primarily in Asia, to make container ship and tanker engines that ‘are in 50% of all world trade’ according to the company’s principal promotion manager, Peter Kirkeby. ‘We are in very deep talks with the market continuously,’ Kirkeby says. ‘There’s a need for a fuel that doesn’t carry carbon.’

If you follow the world’s decarbonisation plans, you might expect the carbon-free fuel that they are testing to be hydrogen, but near this engine you might occasionally be able to smell that you’re wrong. MAN Energy Solutions’ huge test engine is burning a substance that some chemists might even be surprised to hear could be a transportation fuel – ammonia. The gas is very easy for humans to detect by smell, says Kirkeby – and toxic. MAN Energy Solutions is currently determining how to get it into engines safely. ‘Part of the difficulty here is to engineer a system where you do not have any leaks,’ Kirkeby explains. ‘And if you do, you can detect them, and you don’t panic, you will not have an emission of ammonia to an engine room where people work and make their living. To get it from a tank to the engine and keep it at a safe level, that is no simple task.’

The test engine now features safety and supply systems suited to ammonia, but otherwise looks like most other large two-stroke marine engines. MAN Energy Solutions will start to use it in tests burning ammonia as fuel in 2022. A further key landmark on ammonia’s voyage will come in 2024, when the company hopes to deliver its first engine that can burn either ammonia or conventional oil fuel. Ammonia burns less well than oil-based fuels, but Kirkeby stresses that these enormous engines in container ships are well suited to dealing with this challenge through brute force. ‘We can contain a lot of pressure and deal with high temperature,’ he says. ‘It will handle a lot of abuse.’

Burning questions

With ammonia being toxic and poorly suited to internal combustion engines, why is the shipping industry considering it so seriously as a fuel? One reason for strong interest in cleaner marine engines is because shipping accounted for 2.6% of global carbon dioxide emissions in 2015, according to the International Council on Clean Transportation. The International Maritime Organization has therefore set a target to decarbonise 50% of shipping fuel by 2050.

How can chemical companies produce enough ammonia to fuel the world’s shipping fleet?

A second reason is that it’s difficult for container ships to move away from fossil fuels, because they need as much space as possible for cargo. To power cargo ships with batteries, for example, you would need around 10–100 times as much space as their fuel tanks currently take up. You might be able to use a hydrogen fuel tank that’s four times as large as with oil – if you can keep it at –253°C and at least 350 times atmospheric pressure.

To provide the same propulsion, ammonia will take up around three times as much space as oil, cooled to either –33°C or compressed to 10 times atmospheric pressure. That’s a better proposition than hydrogen or batteries. Burning ammonia will mainly produce nitrogen and water but is only truly green if the ammonia has also been produced without greenhouse gas emissions.

To sail away from greenhouse gas-emitting fuels towards ammonia, the shipping industry must therefore tackle three key challenges. First, how can ships best burn ammonia in a combustion engine? Second, how can the industry set up the infrastructure needed to safely supply ammonia, given that shipping might demand more than current total world ammonia production? And third, the big one: How can chemical companies produce enough to fuel the world’s shipping fleet, without emitting greenhouse gases?

Fuelling success

As in the Copenhagen research centre, the clues that researchers in Christine Rousselle’s engineering lab at the University of Orléans in France are burning ammonia are subtle. Rousselle’s team uses a regular 1.6 litre gasoline direct injection (GDI) engine that gives no clues to its fuel as it runs. You might notice, however, that the team’s technicians wear masks when working on the engine. They started working with ammonia fuels in 2016 when Rousselle jointly supervised PhD student Charles Lhuillier with Francesco Contino from UC Louvain in Belgium. That’s fitting because Belgian buses were the first vehicles to use ammonia as a combustion fuel in 1942, during second world war petrol shortages.

Contino and Rousselle wanted to use an unmodified ammonia-powered GDI engine, which ignites fuel with sparkplugs, as an auxiliary electricity generator. With just a mixture of ammonia and air, Lhuillier couldn’t guarantee that the fuel would ignite in the engine. So, the researchers premixed the ammonia with hydrogen before injecting it into the engine.

Including a small amount of conventional fuel will not take anything away from what a giant leap ammonia is towards decarbonising shipping

Rousselle’s team has also tested this mixture in diesel engines, which usually don’t use sparkplugs to ignite their fuel. Instead, they exploit the fact that increasing pressure increases temperature but reduces fuel’s ignition temperature, compressing diesel until it spontaneously ignites. The Orléans researchers found they had to add sparkplugs to get ammonia fuel to run in a four-stroke car diesel engine. Two-stroke marine engines are powerful enough to force the thick heavy fuel oil they normally use to autoignite, but even they are unlikely to make ammonia do so, Rousselle says.

To start with, MAN Energy Solutions is therefore combining ammonia with 5% oil, which will create a pilot flame that will help ammonia ignite. ‘Long term, of course, you want to be rid of a pilot fuel,’ says Kirkeby. ‘But looking at the emission reductions green ammonia can bring, a small amount of pilot fuel will not take anything away from what a giant leap it is towards decarbonising shipping.’

Rousselle suggests that ships could ultimately replace oil in that mixture with hydrogen produced by breaking down ammonia. From her perspective the biggest challenge will be getting enough ammonia moving through the engine. ‘The energy from combustion of ammonia is small, which means that fuel consumption will be higher,’ she says.

Navigating towards decarbonisation

Ammonia’s feasibility as a fuel has enabled Danish shipping giant Maersk to include it as a pathway towards its 2050 target for carbon neutral operations. After the company announced the goal in 2018, it has been analysing which fuels and technologies could contribute, says Berit Hinnemann, Maersk’s head of decarbonisation business development.

We need to be able to understand the risk of ammonia spills

Even though the world has experience making and shipping ammonia at large scales as fertiliser, Hinnemann explains, there remain great technical and safety challenges to its use as fuel. Maersk needs to know that ammonia is ready to use before it can even think about when to deploy it and how much it might need, she adds. The company is therefore looking at how it can securely store ammonia and the precise details of how to handle ammonia safely on board ships. ‘Ammonia is toxic to people and to life in the water,’ she underlines. ‘So we also need to be able to understand the risk of ammonia spills.’

As a result, ammonia is not Maersk’s lead decarbonisation pathway. It instead favours continued use of at least some carbon atoms. Maersk is already using biodiesel and has announced that it will introduce eight ships powered by carbon-neutral methanol in 2024. Methanol is more advanced than ammonia is because there is an established process to make biomethanol from biomass waste, says Hinnemann. In future, she adds that Maersk will use e-methanol, using ‘green’ hydrogen made by electrolysing water using renewable energy, and a carbon source, like biogenic carbon or captured carbon dioxide, she adds.

Green ammonia will also use green hydrogen, and nitrogen from the air. That’s potentially more appealing, but not yet widely available. ‘For green ammonia, you do not need a carbon source and therefore, in principle, the upscaling only depends on the amount of renewable energy you have,’ says Hinnemann. ‘What the fuel mix will look like in the future, we have to see.’

But at Monash University in Melbourne, Australia, a team of chemists has a vision of when green ammonia will be available, and in what quantities, to offer the shipping industry.

Travelling from brown to green

Without any carbon atoms, ammonia may appear at first glance to be completely decarbonised. Yet today, ‘brown’ ammonia is produced using the carbon-intensive Haber–Bosch process, responsible for around 1% of greenhouse gas emissions. So, in 2020, Doug MacFarlane’s Monash team published a ‘Roadmap to the Ammonia Economy’, showing how to eliminate greenhouse gas emissions over three technology generations.

The first generation uses existing Haber–Bosch technology, adopting carbon capture and offsetting, yielding ‘blue’ ammonia. This production will start decreasing by 2030 as second-generation technologies clean up the Haber–Bosch process’s hydrogen supply. This involves green hydrogen produced by splitting water electrolytically, powered by renewable energy, replacing hydrogen made carbon-intensively from steam reforming of methane.

We are aiming for smaller scale markets at first, such as distributed on-farm production of fertilisers

Within a few years a third-generation process being developed by Monash spinout Jupiter Ionics will then start to take over, explains Jacinta Bakker, the company’s senior research coordinator. ‘It is an electrochemical process that has an inbuilt electrolyser that can be constructed in modules and thus stacked and upscaled to meet the world’s demand for ammonia just using the sun, the air and seawater,’ she explains. It uses a reduction process to convert nitrogen in the presence of lithium salts into lithium nitride, which the chemists protonate to produce ammonia. The process has been known since 1930, and usually consumes ethanol to provide the protons. But in 2021 the Monash team published a route using a tetraalkyl phosphonium salt in place of ethanol, providing a stable, continuously recycling proton source.

Lithium’s role might ring alarm bells, given the current enormous demand for the element from batteries. However, Bakker stresses that the approach uses only small amounts of lithium that are completely recycled in its processes, while the Monash researchers are also investigating other metals. Meanwhile, although Jupiter Ionics aims to scale up to meet the volumes needed for shipping fuel, it’s a big challenge, Bakker adds. If shipping is entirely powered by ammonia, it will likely need triple the amount currently used as fertiliser, according to Monash’s roadmap. ‘We are aiming for smaller scale markets in the first stage, such as distributed on-farm production of fertilisers and fuels,’ Bakker says.

In the UK, Edman Tsang’s team at the University of Oxford is developing technologies at several green ammonia production process stages. For example, in 2018 working with Siemens they deployed a wind-powered green ammonia synthesis demonstrator in Harwell, UK. More recently, Tsang’s team has improved the process of splitting water electrolytically by swapping platinum catalysts for silver nanoparticles or using light using a combination of titania and magnesia catalysts. They’ve also developed methods to make ammonia electrochemically using molten electrolytes and ruthenium catalysts.

The Oxford researchers are now involved in shipping due to ‘substantial incentives from UK and Europe to develop green ammonia as maritime fuel’, Tsang says. In September 2021, the UK government awarded £1.6 million to a collaboration including Tsang’s spin-out, Oxford Green Innotech, and Ocean Infinity, a shipping company from Southampton, UK. They are developing an ammonia fuel cell marine propulsion system that could be more efficient than combustion engines and reduce vessels’ greenhouse gas emissions by 90%. The system can convert ammonia to hydrogen that powers the fuel cell. However, such fuel cells are further from commercialisation than combustion engines, with Tsang highlighting the space issue and chemical challenges such as finding efficient catalysts.

Avoiding new hazards

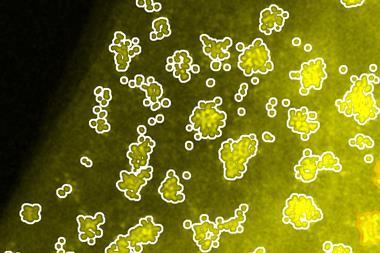

To power ships without greenhouse gas emissions, though, there are issues beyond how ammonia is made. It’s also important to consider how it’s contained and burned, Bakker stresses. Using ammonia fertiliser incorrectly or excessively already releases problematic nitrogen oxides (NOx) into the atmosphere, or nitrates into waterways that encourage algae blooms, she notes. Using ammonia as a fuel will multiply these risks.

For ocean-going shipping, there’s no silver bullet solution that ticks all the boxes

Meanwhile, although ammonia can burn cleanly to produce nitrogen and water, there’s also a risk it may form NOx emissions. ‘Even small releases of incidental NOx by-products or ammonia itself will be catastrophic in the environment,’ says Bakker. ‘It is crucial that emission abatement technologies, monitoring and management policies develop in tandem with net zero ammonia technologies. We don’t want to replace our carbon problem with a nitrogen problem.’

Some aspects of this challenge already have a solution. Diesel road vehicle engines already limit NOx emissions using selective catalytic reduction systems such as AdBlue, Rousselle notes. This generates ammonia to react with and minimise NOx but can also emit excess ammonia in tiny amounts as a by-product. Container ships also already use such systems to remove NOx from their exhausts.

Maersk’s Hinnemann stresses the need to look throughout the ammonia-making process to avoid any other issues that could drive further climate change. ‘We don’t want to just push greenhouse gas emissions somewhere else,’ she says. She adds that the Sixth Assessment Report of the United Nations Intergovernmental Panel on Climate Change, published in 2021, ‘has really underscored that we need to start doing something in this decade’. Ammonia might seem a distant prospect for such urgent action, but Hinnemann underlines that it’s as likely a solution as other substances. ‘For ocean-going shipping, there’s no silver bullet solution that ticks all the boxes,’ she says. ‘All these fuels have pros and cons.’

Andy Extance is a science writer based in Exeter, UK

No comments yet