Ineos is filing a raft of antidumping complaints over chemical imports to Europe. The chemicals group says chemicals from Asia, the Middle East and the United States are unfairly undercutting European producers. Yet some analysts doubt that the European chemical sector can be saved by the current antidumping regime.

Imports from China surged by 8% in the first half of 2025, ‘flooding Europe with carbon-intensive products that pay a fraction of our energy costs and no carbon price at all,’ said Ineos in a statement critical of EU action. The EU–US trade deal left Europe more vulnerable to dumping, it added.

‘Global commodity chemicals are in oversupply right now,’ says Seth Goldstein, a chemical equity analyst at Morningstar. ‘We’ve seen supply grow much faster than demand over the past few years.’ Asia now generates 57% of the world’s plastics, with China accounting for 35% – almost three times more than the entire EU.

The European Commission must decide what imports constitute dumping – meaning they are being sold at artificially low prices. It can then apply specific import tariffs to individual companies’ products to try and deter dumping. ‘Dumping refers to countries that have either a strong cost advantage or are getting government subsidies,’ says Goldstein. The commission took 162 anti-dumping measures, including 62 against companies in China, in 2024.

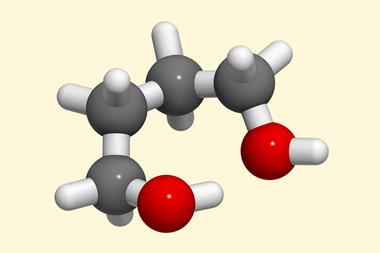

Ineos listed 10 essential chemicals in its submissions to the EU. It described them as crucial to Europe’s automotive, electronic, construction, packaging and pharmaceutical industries; the list included chemicals such as polyvinyl chloride, butyl acetate and polyolefins.

In 2024, the commission launched a record 33 investigations, including 12 in the chemical sector. Products included epoxy resins (used in composites and adhesives) from China, South Korea, Taiwan and Thailand, and thermoplastic acrylonitrile-butadiene-styrene (ABS) from South Korea.

The commission determines whether goods are sold in the EU below their ‘normal value’, taking into account production costs, benchmarks such as energy costs and reasonable profit margins. The commission then weighs up any injury to EU industries and decides on a percentage tariff. Investigations run for 12 to 15 months, with preliminary duties proposed 6–9 months after initiation, and usually finalised 3–6 months later.

It is usually better for Chinese producers to ship excess production at any price than run plants at lower capacity. That is when dumping becomes an issue

The commission started looking at polyethylene terephthalate (PET) from China in March 2023. It noted that PET producers there are fully or partially state owned and benefit from government interventions, and calculated a normal PET value by reference to Malaysian producers. It imposed levies of between 7% and 24% on various Chinese PET producers for five years. The commission also investigated alkyl phosphate esters from China, organic compounds used as lubricants, surfactants and flame retardants. Based on prices from Brazil, it imposed antidumping duties of 53% to 68% on Chinese imports.

Such measures are not enough, said Ineos. European makers of ABS incurred losses equivalent to two-thirds of their normal profitability due to unfairly priced imports, it said, and a 3.7% anti-dumping duty proposed by Brussels is too low.

Chemicals submitted by Ineos for investigation included monoethylene glycol (MEG), used in PET plastics and polyester textiles. US and Saudi Arabian crackers have lower production costs and higher margins for MEG, while ‘there’s an oversupply in Asia and they just might want an outlet for their production,’ says Mohamed Chilmeran, petrochemical analyst at Wood Mackenzie.

Antidumping tariffs might support short-term prices in Europe, but we don’t believe they will help the domestic market

It’s significant that China has built lots of state-of-the-art, fully integrated production facilities, putting a premium on operating as close to maximum capacity as possible. ‘It doesn’t matter if some products are negative in margins, if the overall plant is positive and they continue operating at high rates,’ says Chilmeran.

Excess production incentivises exports, even at depressed prices. ‘If Chinese local demand has not caught up with the new capacity,’ says Alasdair Nisbet, chief executive of Natrium Capital, a chemical industry mergers and acquisitions advisor. ‘It is usually economically better for Chinese producers to put the excess production on a boat and ship it at any price than run the plant at lower capacity,’ he adds. ‘That is when dumping becomes an issue.’

Some analysts criticise EU countermeasures as ineffective. In August, the commission began an investigation into dumping of PTA (purified terephthalic acid) by South Korea and Mexico. This could trigger extra duties, but some analysts doubt this would help European producers.

‘Perhaps they might support short-term prices in Europe, but we don’t believe antidumping tariffs will help the domestic market,’ says Santiago Castro at Wood Mackenzie. ‘The market share will shift from Mexico and South Korea, likely to China and possibly Turkey.’ An Ineos PTA facility in China, or others in Asia, could still export into Europe at relatively low prices, without necessarily constituting dumping.

European facilities are subject to higher labour and production costs and pricier feedstocks, especially in the absence of cheap Russian gas. Several European crackers have closed due to competition, although Ineos is building a new plant in the Netherlands, to be fed with imported US shale gas. ‘US and Middle East crackers are much cheaper and they can export to Europe and undercut European producers,’ says David Buckby, polyolefins analyst at Wood Mackenzie.

There’s not been enough analysis by governments into the strategic molecules that are important for both the chemical industry and for industry as a whole

Chinese facilities have lower costs and are supported by state policies. ‘China set out on a deliberate strategy to dominate global supply chains and manufacturing,’ says Buckby. A lot of countries now also aim to be more self-sufficient in chemicals, such as India and Indonesia, as well as Turkey, which launched its own polypropylene industry. Economic logic dictates that profit margins for petrochemical commodities like polypropylene and polyethylene will therefore remain poor, notes Buckby: ‘National strategic concerns will override such concerns in lots of places.’

The EU drew up a plan for strengthening the chemical sector in July. ‘The rhetoric sounds like they’re going to take big and meaningful action, but many worry that new legislation will be a damp squib,’ says Buckby. The EU’s trade agreement with the US in July served to darken the mood further. If approved, it would see EU tariffs on a range of chemicals fall to zero from 6.5%, including polyethylene and polypropylene. ‘The EU for the past 12 months said it wanted to protect our chemicals industry, but lower tariffs on US chemicals undermines this,’ says Buckby.

‘The US is no longer playing by the rules,’ observes Buckby, meaning it is prioritising protection of its national industry over globalised trade. This has likely resulted in some chemicals from Asia being rerouted from the US to Europe to avoid new US tariffs. ‘China has not been playing by the rules for some time and has doubled down on its overcapacity.’ The EU wants to protect its chemical sector, but the response is slow and legalistic, say analysts. ‘If they want to make Europe competitive and protected from Asian imports, instead of anti-dumping investigations, they could put [broader] tariffs on particular products,’ says Castro.

Claims of dumping are a balancing act for governments. ‘The downstream companies that buy chemicals probably don’t mind having a cheaper price and that helps their business,’ says Goldstein, meaning European automotive, construction and durable goods manufacturers. ‘There is a tension right now between defending European manufacturing from imports, encouraging a green agenda and keeping inflation down,’ says Nisbet. ‘Industry is frustrated. They bought into the green agenda, which is applied to chemical products in Europe, but it’s not always applied to the finished goods made from chemical products,’ says Nisbet.

The situation moves much faster than politicians and civil servants in Europe and elsewhere can cope with

Many European chemical manufacturers run highly integrated plants, where byproducts from one process become inputs for another, improving efficiency and reducing costs. ‘Once you start losing individual products [through competition], it undermines the integration and the industry as a whole starts losing competitiveness,’ says Nisbet, particularly if losses from some products can’t easily be compensated by other production. ‘There’s not been enough analysis by governments into the strategic molecules that are important for both the chemical industry and for industry as a whole. Once you lose these molecules, your industrial base shrinks very quickly.’

Europe’s global market share in plastics fell from 22% in 2006 to 12% in 2024, with industry turnover dipping from €457 billion in 2022 to €398 billion in 2024, according to trade association Plastics Europe. Profit margins on those sales were also much smaller. ‘Europe’s decline contrasts starkly with the industrial boom taking place in other regions,’ notes Katharina Schlegel Thummer, circularity director at Plastics Europe. The industry stands ‘at a cliff edge as our competitiveness collapses,’ she adds.

Analysts expect that the EU will respond, but slowly. ‘The situation moves much faster than politicians and civil servants in Europe and elsewhere can cope with,’ says Nisbet. For now, many in the European chemicals sector are deciding to wait and see. ‘If the EU doesn’t take meaningful action by the end of 2026, I think that’s when we could see another wave of European producers give up hope and close more facilities,’ says Buckby.

No comments yet