Following years of lengthy litigation, US pharma giant Johnson & Johnson (J&J) has offered to pay $8.9 billion (£7.2 billion) over the next 25 years to settle current and future allegations that the company’s baby powder and other talc products were responsible for tens of thousands of cancer diagnoses in North America.

The settlement involves a second bankruptcy filing for J&J’s subsidiary LTL Management, which was created in 2021 to absorb the company’s talc lawsuit liabilities. It represents an increase of $6.9 billion over the $2 billion that J&J previously committed in the initial bankruptcy filing for LTL in October 2021.

Lawyers representing more than 60,000 claimants currently pursuing J&J for damages have committed to support the new proposal, which requires approval in a bankruptcy court and the signoff of at least 75% of claimants.

If the settlement is accepted, the company would ‘resolve all current and future talc claims,’ J&J said in its US Securities and Exchange Commission filing. The company emphasised, however, that its re-filing of bankruptcy for LTL is neither an admission of wrongdoing, nor an indication that it has changed its longstanding position that J&J talcum powder products are safe.

Supreme Court ruling

LTL’s new Chapter 11 filing comes after the appeals court earlier this year rejected J&J’s effort to offload on these lawsuits over its talc products into bankruptcy court. J&J is now hoping to get the green light from the US Supreme Court for its plan to channel tens of thousands of these pending talc lawsuits into LTL. When J&J first announced its strategy to spin the talc liabilities off into bankruptcy in 2021, an automatic stay took effect that essentially froze proceedings in thousands of talc cases and prevented new lawsuits from being filed.

This is the largest products liability settlement ever achieved after a bankruptcy filing

Mikal Watts, capital partner at Watts Guerra

At the time of the first LTL bankruptcy filing, there were about 45,000 cases against J&J where plaintiffs claimed that the company’s talc products caused their cancers, according to Mikal Watts, a capital partner at the San Antonio, Texas law firm Watts Guerra that is representing J&J talc claimants. The current number of such cases is unknown because of the administrative stay, he says.

‘The implication is that tens of thousands of women get to decide whether they want their cases settled in this way or not – the women as opposed to their lawyers get to control the future of this litigation,’ Watts tells Chemistry World. ‘The lawyers representing about 60,000 women have agreed to support the proposed plan, but again it is up to the clients – just because a single lawyer comes out for or against J&J’s proposed settlement doesn’t mean their thousands of clients will be for or against it.’

A ‘meaningful step’

In a 5 April research note, JP Morgan senior pharmaceuticals analyst Chris Schott describes J&J’s bankruptcy re-filing to consolidate all the company’s talc claims as ‘a meaningful step to resolving the talc overhang’ on the company’s shares.

The initial 60,000-plus claimants that support the settlement proposal will quickly increase to at least 70,000, Schott predicts and the total number of claims is estimated to be 90,000. Schott said it is therefore likely J&J will obtain the 75% support required for approval.

In terms of next steps, Schott expects that J&J and the claimants will probably submit a formal reorganisation plan by the end of May. Then the voting discovery process will begin to determine the eligible claims. He anticipates formal voting by eligible claimants will occur by the end of the summer.

Differences of opinion

‘This is the largest products liability settlement ever achieved after a bankruptcy filing,’ stated Watts, whose firm represents many of the talc plaintiffs. ‘J&J committed $2 billion when it filed 18 months ago. Today, it committed $8.9 billion to fairly compensate these deserving women,’ he said.

But other lawyers have criticised the proposed deal as insufficient. ‘J&J is seeking an extremely deep discount on justice and is not really offering anything other than another bankruptcy and more delay tactics,’ said Andy Birchfield, an attorney with the law firm Beasley Allen, based in Alabama. ‘An $8.9 billion amount is woefully inadequate to cover even the current ovarian cancer and mesothelioma claims, much less any future claims,’ he added.

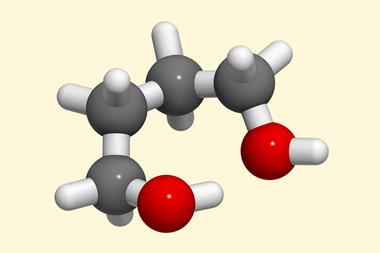

In the meantime, J&J pulled its talc-based baby powder from shelves in North America in 2020, and the company has announced a plan to stop sales of the product worldwide by the end of this year. It will be replaced cornstarch-based formulations that are already sold in many parts of the world.

More research needed

Despite the settlement, J&J still maintains that its talc products are safe for humans. John Kim, LTL’s chief legal officer, said there is a ‘lack of scientific validity to these claims’ against J&J talc products.

The World Health Organization’s International Agency for Research on Cancer (IARC) classifies perineal use of talc-based body powder as ‘possibly carcinogenic to humans’. While some studies have suggested a possible link, there ‘isn’t good enough evidence’ to definitively say that talcum powder causes ovarian cancer, according to Cancer Research UK. More research in bigger, higher-quality studies is needed to confirm whether a link exists, the charity suggests.

The American Cancer Society has reached a similar conclusion. ‘Studies of personal use of talcum powder have had mixed results, although there is some suggestion of a possible increase in ovarian cancer risk,’ the organisation says.

J&J is not the only big company to find itself on the legal defence over its talc products. There is also a dispute between Merck & Co and Bayer over who is responsible for potentially billions in litigation relating to talc products Bayer obtained when it acquired Merck’s consumer care unit back in 2014 for more than $14 billion.

Earlier this month, a Delaware judge tossed out Merck’s lawsuit that argued Bayer should bear the responsibility. The judge concluded that the terms of the purchase specify that Merck indefinitely retained substantive liability for claims related to products sold before the transaction closed.

‘We are disappointed with the decision and we plan to appeal,’ Merck said in a statement.

No comments yet