Pharmaceuticals roundup 2025

It’s been a turbulent year for the pharmaceutical industry, with US political decisions having broad ramifications both at home and abroad. Donald Trump’s on-again off-again tariff announcements have made for a challenging market environment, and his desire for ‘Most Favored Nation’ pricing has left companies scrambling to do deals on price cuts in the US, and ramp up their US-based operations.

At time of publication, proposed tariffs of up to 100% have been delayed to give pharma companies more time to cut their prices. Pfizer was the first company to say it would start selling medicines directly to patients via a government online platform, trumprx.com, that is expected to go fully live in January. Several other companies have also said they would start selling at least some of their medicines directly to patients, including Amgen, AstraZeneca, Bristol Myers Squibb (BMS), Lilly, Novartis and Novo Nordisk.

The prospect of price cuts in the US has led to pricing structures being challenged elsewhere, including the UK and the EU, and companies looking to charge more for medicines outside the US. In the UK, for example, a deal struck by the government will stave off Trump’s tariffs for three years in exchange for increasing the National Institute for Health and Care Excellence’s cost-effectiveness thresholds, which had – much to the chagrin of pharma companies – remained unchanged for more than 20 years, exacerbating the transatlantic differential. The UK will also reduce rebates that drug companies must pay when sales of branded medicines to the NHS exceed defined levels.

In the US, new Health and Human Services (HHS) secretary Robert Kennedy fired all the members of ACIP, the Center for Disease Control’s independent advisory committee on immunisation practices, to install his own choice of panellists. Many have vaccine-sceptic views. More headlines came with Kennedy and Trump’s claims that taking acetaminophen (paracetamol) in pregnancy causes autism – a pronouncement that left healthcare professionals and regulators around the world scrambling to reassure the public there is no proven link.

This all came after HHS started laying off about 10,000 people across its various agencies, including the Food and Drug Administration (FDA), in a drive to save $1.8 billion (£1.4 billion). Kennedy later rolled back about 2000 of these, saying they had been cut in error.

As well as walking away from the World Health Organization (WHO) again, the US has pulled its funding from Gavi, the vaccine alliance. Kennedy cited his concerns about vaccine safety, but there are broader fears this might increase vaccine hesitancy. The FDA also limited routine availability of Covid vaccines at home.

And after the US Agency for International Development (USAid) was shut down, numerous other developing world programmes are facing significant funding shortfalls. These include HIV and malaria treatment and programmes aimed at stopping the spread of ebola. A report in The Lancet suggested the cuts in aid could lead to at least 14 million additional deaths by 2030.

Blockbuster products

Merck & Co’s immunotherapy blockbuster Keytruda (pembrolizumab) remains at the top of the best-seller list, with global sales of $29.5 million in 2024, ahead of Pfizer–BMS’s anticlotting agent Eliquis (apixaban). Abbvie’s anti-TNF antibody Humira (adalimumab) plummeted from second to 14th on the list after biosimilar competition kicked in. And now in third place is Novo Nordisk’s GLP-1 agonist diabetes treatment Ozempic (semaglutide), although adding in sales of semaglutide branded as Wegovy for weight-loss would push the drug into second.

Such has been the impact of the GLP-1 agonists, both in treating type 2 diabetes and assisting weight loss, that the WHO has added four of them to its list of essential medicines.

Concerns about weight rebound after dosing ends and the loss of muscle alongside fat persist, but the number of studies published that highlight the wider health benefits increased dramatically during 2025. These include better cardiovascular health, reduced cancer risk, and potential improvements in diseases ranging from asthma to rheumatoid arthritis. They might even, potentially, slow down the ageing process.

Many other companies are looking to climb onto the obesity juggernaut, including Innovent with mazdutide (already on the market in China as Xinermei, and being developed globally in collaboration with Eli Lilly), and Amgen’s MariTide (maridebart cafraglutide). Market leaders Novo and Lilly are looking to widen their portfolios, too.

Both semaglutide and its main competitor, Eli Lilly’s tirzepatide (Mounjaro/Zepbound) – number 9 on the 2024 list with annual sales of $9.5 billion – have to be given by injection. An orally available alternative would make life much easier for patients. Lilly’s oral GLP-1 agonist orforglipron is progressing through the clinic, and showed promise in two Phase 3 trials. However, liver injury led to Pfizer discontinuing work on its oral GLP-1 agonist, danuglipron.

Novo’s patents on semaglutide are set to start expiring in 2026, and biosimilar producers are gearing up to compete, which will inevitably lead to a drop in prices. India’s Dr Reddy’s, for example, plans to launch generics in 87 countries in 2026, and roll them out to Europe and the US in subsequent years as patents expire.

Deals and investments

What had been a relatively calm and quiet year on the mergers and acquisitions front became decidedly less so in November, when Pfizer’s attempt to buy obesity specialist Metsera turned into a full-blown bidding war with Novo Nordisk. Ultimately Pfizer prevailed, with its initial bid of up to $8.1 billion bid trumped by Novo’s counterbid of up to $10 billion. Pfizer tried (and failed) to block Novo’s offer in court, and then upped its offer to match Novo’s. Metsera accepted it, not least because there would be significant competition concerns with a Novo acquisition.

There were a couple more double-digit deals. The first came in January, with Johnson & Johnson’s $14.6 billion acquisition of US-based Intra-Cellular Therapies and its treatment for bipolar and schizophrenia Caplyta (lumateperone), plus a pipeline for other central nervous system disorders.

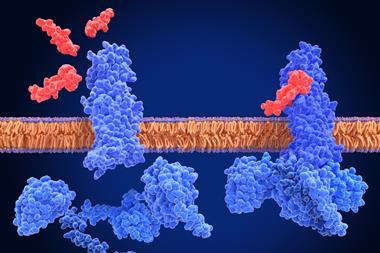

The second came in late October, with Novartis paying $12 billion for Avidity Biosciences, which has three drugs for neuromuscular diseases – two forms of muscular dystrophy and myotonic dystrophy – in late-stage clinical trials. Avidity’s preclinical cardiovascular programmes will be spun out before the acquisition completes. Novartis also spent $1.4 billion on Tourmaline and its IL-6 monoclonal antibody pacibekitug, which is in development for atherosclerotic cardiovascular disease, and $1.7 billion on Regulus and its polycystic kidney candidate farabursen.

Sanofi’s June acquisition of Blueprint came close to double digits, at $9.1 billion. Blueprint has a development pipeline for immunological disease, and a marketed drug for systemic mastocytosis, avapritinib (Ayvakit/Ayvakyt). It also paid $470 million for Vigil and its Alzheimer’s candidate VG-3927, a Trem2-targeting antibody, and $1.6 billion for early-stage vaccine company Vicebio. Another biologic-based deal came in November, when Merck & Co spent $9.2 billion on Cidara and its Phase 3 antibody fragment for influenza.

Novo Nordisk did manage to buy Akero Therapeutics for $4.7 billion up front, with its metabolic dysfunction-associated steatohepatitis (Mash) treatment efruxifermin, which is in Phase 3. Also making a move into Mash is Roche, which is paying $3.5 billion for 89bio, whose FGF21 analogue pegozafermin is also in Phase 3.

Another Danish company, Genmab, is paying $8 billion for Dutch oncology specialist Merus, including the bispecific antibody petosentamab, in Phase 3 for head and neck cancers. Also in the oncology space, Merck KGaA paid $3.4 billion for US-based SpringWorks, which has two licensed cancer treatments.

GSK, meanwhile, is spending $500 million up front (and up to $12.5 billion in total) on global rights for up to 12 development candidates from Chinese company Hengrui. It is far from the only company investing in Chinese-discovered projects, with a July report from Jefferies saying that in the first quarter of the year, almost a third of biotech out-licensing deals were from China. For example, Pfizer signed a $1.25 billion deal with 3SBio on anticancer bispecific SSGJ-707 targeting PD-1 and VEGF. And Roche has signed a deal worth up to $1 billion with Innovent for IBI3009, an antibody–drug conjugate targeting DLL3 for small-cell lung cancer.

Cuts and strategies

The manufacturing landscape is changing, too. Companies are increasingly scurrying to set up and expand their manufacturing operations in the US amid the turbulent tariff environment, and hiking capacity elsewhere to meet changes in global demand. Lilly, for example, is spending $1.26 billion on a facility in Puerto Rico for oral medicines, and a further $3 billion on another in Katwijk, the Netherlands. AstraZeneca said it will invest $50 billion in the US by 2030, including building a manufacturing facility in Virginia, while GSK has said it will invest at least $30 billion in manufacturing and R&D in the US in the coming five years, including a new biologics facility in Pennsylvania. And Amgen will spend $900 million to expand its Ohio manufacturing operations.

There’s been a good deal of capacity investment in China, too. Roche said it will spend $300 million on expanding its manufacturing activities in the country, and AstraZeneca is set to spend $2.5 billion on an R&D hub in Beijing. Meanwhile WuXi Biologics is building a biologics plant in Chengdu that will be able to fill more than 10 million vials a year. GLP-1s are also driving investment, with Novo Nordisk spending more than $1 billion on a production site in Brazil.

On the down side, more big job cuts are on the way at Merck & Co, with 6000 staff set to lose their jobs as part of a plan to save $3 billion a year by the end of 2027. Moderna is also aiming to make big savings, with plans to cut staff numbers by about 10%. Bristol-Myers Squibb is cutting several hundred jobs in New Jersey, US, with the state also facing more than 400 job losses at Novartis.

Despite the success of Ozempic, Novo Nordisk has been struggling in the face of increased competition, and its new chief executive Mike Doustdar is making deep cuts to the workforce, saying the company must evolve to meet future market demands. As part of a $1.6 billion cost-cutting plan, 9000 employees will lose their jobs, more than half of them in Denmark. It includes a complete exit from cell therapy research.

This mirrors a wider swing away from cell and gene therapy during the year. Galapagos, for example, is to stop work in the sector, closing five sites with a loss of 365 jobs. Takeda is exiting the field, too, with job losses at its Massachusetts, US R&D site, although it is looking for a partner to work take over its cell therapy platform and preclinical pipeline. On the gene therapy side, Biogen has stopped work on adeno-associated virus capsid vectors.

Meanwhile, in the UK, concerns about government support for the pharma industry have crystallised in AstraZeneca, Lilly and Merck & Co all stopping or pausing major investments in the country. The Association of the British Pharmaceutical Industry has warned that unwillingness to spend on new medicines could also undermine the UK’s global competitiveness as a location for developing, manufacturing and launching them, despite the government declaring life sciences a priority in its industrial strategy.

However, as part of the NHS 10 Year Plan announced in July, the government did include a £600 million investment in a health data research service in partnership with the Wellcome Trust. Its aim is to give better access to national health datasets, and cut the time it takes to set up new clinical trials. Whether this helps to turn the tide on industry investment in the country remains to be seen.

No comments yet