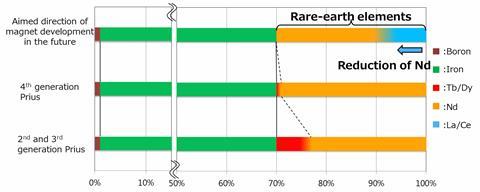

Careful material engineering enables alloys using more abundant rare earth elements than neodymium

Japanese carmaker Toyota says it can cut the cost of rare earth element-containing magnets within the motors of electric vehicles by replacing up to half the neodymium in them with the more abundant, lower-cost rare earths lanthanum and cerium.

Toyota expects these magnets to be used in motors for electrified vehicles within 10 years. They could also be used in electric power steering and other applications including robots and various household appliances by the first half of the 2020s.

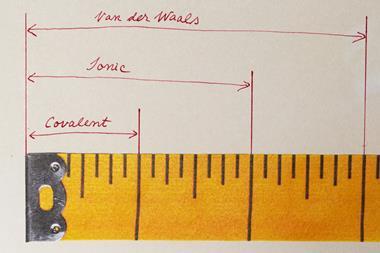

Neodymium is important in ensuring alloys keep their residual magnetism, a property known as coercivity, even at high temperatures. Permanent magnets are therefore currently made of alloys mixing neodymium, iron and boron, as Nd2Fe14B. As with all magnets, the magnetic field of Nd2Fe14B alloys comes from the magnetic dipole moment of electrons within them, which originates from their spin. In materials with filled shells of electrons, all the electrons are organised in pairs with opposite spin, and the magnetic field cancels out. In materials when they’re unpaired, they can align, creating a magnetic field.

Nd2Fe14B alloys are ferromagnets, meaning that virtually all their electrons’ spins are aligned in the same direction. But such materials are subdivided into many small grains, producing magnetic fields potentially pointing in different directions. If the fields are all randomly oriented, the materials have little or no magnetism. Putting them in a magnetic field can align the grains and make the materials more strongly magnetised.

Collaborate to innovate

This directionality, known technically as anisotropy, has several causes. These include the intrinsic magnetic directionality of crystalline materials, known as magnetocrystalline anisotropy, and the shape of the grains. Nd2Fe14B alloys have exceptionally high intrinsic magnetocrystalline anisotropy, making them very difficult to magnetise any direction other than their preferred one. That originates specifically from neodymium’s unpaired electrons, and helps make the magnets coercive. Meanwhile the large proportion of iron means that such alloys can be strongly magnetic.

Tetsuya Shoji, group manager of Toyota’s advanced material engineering division, says that the company has been working on magnet research since 2004. Though none of the team had any experience with magnets initially, he explains, ‘many researchers globally helped and enhanced our understanding’, enabling Toyota to develop the new material on its own. ‘This collaboration with experienced and famous researchers to reveal the coercivity mechanism remains an important activity to deepen our understanding of magnets,’ Shoji tells Chemistry World.

The collaboration helped Toyota to turn to cerium and lanthanum. These elements are much more abundant than neodymium, but due to their lower intrinsic anisotropy direct replacement produces much less coercive alloys. To enable the substitution Toyota therefore carefully engineers its magnets’ structure to compensate. One of its innovations is making grains largely from cerium, iron and boron, for example, and surrounding them with highly anisotropic shells containing more neodymium that suppress magnetisation reversal.1

Not so rare

One reason this structure may be beneficial is that grain-edge defects seem to help magnetisation reversal. ‘Engineering materials where the grains are protected by a high-anisotropy shell is a useful way of maintaining coercivity at higher temperatures,’ says the University of York’s Roy Chantrell whose team has worked with Toyota in modelling such systems.2 These models are helpful for exploring such designs, he adds.

Coercivity also depends on grain size, and Toyota and collaborating academics have found that it reduces rapidly as grains get bigger.3 The carmaker therefore retains high coercivity at high temperatures through shrinking grains to one-tenth or less of the size of those found in conventional neodymium magnets. Thanks to these improvements, Toyota’s magnets maintain the same heat resistance as existing ones, but reduce the amount of neodymium used by up to half.

Julie Klinger, an expert in rare earth mining at Boston University, US, notes that cerium and lanthanum cost $5-$8/kg (£4-6), compared to $45-$70/kg for neodymium. Given that there is currently a global oversupply of rare earth elements, she believes this is the most important outcome. ‘Lowering the cost is good news, because it may translate into more affordable electric vehicles,’ she says. ‘The next step for Toyota and other manufacturers is to design their rare-earth bearing components in ways that can be easily recycled.’

References

- S C Westmoreland et al, Scr. Mater., 2018, DOI: 10.1016/j.scriptamat.2018.01.019

- M Ito et al, AIP Adv., 2016, DOI: 10.1063/1.4945040

- S Bance et al, J. Appl. Phys., 2014, DOI: 10.1063/1.4904854

No comments yet