With lithium-containing batteries facing constraints on many of the metals they contain, Nina Notman looks at whether its group 1 neighbour sodium can supply the answer

The lithium-ion battery powers much of our modern lives, a fact reflected in this year’s Nobel prize. It resides in devices ranging from very small wearable electronics, through mobile phones and laptops, to electric vehicles and ‘the world’s biggest battery’ – the huge 100MW/129MWh Tesla battery installed on an Australian wind farm in 2017.

‘Lithium-ion has a massive span of applications,’ explains Jonathan Knott, an energy storage researcher at the University of Wollongong in Australia. ‘It is being used as a hammer to crack every nut and we need to start getting a little bit more sophisticated in the use of the best tool for the job.’

A number of disruptive battery technologies are jostling to take a share of lithium-ion’s multibillion pound market – currently valued at over $37 billion (£30 billion), and projected to reach $90 billion within five years. For sodium-ion batteries, its developers have primarily (but not exclusively) set their sights on the large-scale, stationary market – such as Tesla’s Australian installation.

Size matters

John Goodenough, one of the 2019 Nobel laureates, played a key role in the development of the rechargeable lithium-ion battery cathode at the University of Oxford in the early 1980s. Before lithium-ion charge carriers were settled upon, Goodenough looked at using ions from the element directly below it on the periodic table – sodium. ‘However, because Li+ intercalation is faster than Na+ intercalation, our attention turned to rechargeable cathodes exhibiting Li+ intercalation,’ he tells Chemistry World.

The lithium cobalt oxide cathode was created, the graphite anode devised, and the rest as they say is history. ‘Lithium-ion technology was picked up by Sony in 1991 and its use exploded,’ says Mauro Pasta, a battery researcher at University of Oxford in the UK.

In recent years, however, sodium has been having somewhat of a revival, thanks to its availability. ‘Although there are sufficient supplies of lithium [on Earth], these are not necessarily located in convenient places. Sodium is ubiquitously accessible from the oceans of the world,’ Goodenough explains.

In addition, electrodes in lithium-ion batteries contain cobalt. Electrodes for sodium-ion batteries don’t have to. Cobalt is expensive and there are significant ethical concerns regarding its mining practices. It is sometimes referred to as the blood diamond of the elements. Safety is another potential benefit. The cells can be completely discharged and transported at zero volts, circumventing the increasingly stringent transportation regulations covering lithium-ion batteries.

In terms of advantages over other disruptive battery technologies, however, it is the similarities between the sodium- and lithium-ion battery that are the former’s biggest selling points and are smoothing its path to market. ‘Sodium ions have similar intercalation chemistry to lithium ions and so, not surprisingly, a lot of materials being tested for sodium batteries are similar to those used for lithium,’ explains Saiful Islam, a materials chemist at the University of Bath in the UK. The manufacturing processes are also similar. ‘Any of the [Tesla] Gigafactories that are producing lithium-ion batteries will be fully adaptable towards sodium-ion technology,’ Pasta says.

But the differences between the two go beyond the intercalation – charging – speed that Goodenough noted in the 1980s. A key issue is that because sodium ions are larger than those of lithium, the energy density of batteries containing them – the amount of energy that can be stored in any given volume – is naturally lower. This directs sodium technology towards stationary applications where the size of the battery doesn’t matter as much.

Gigafactories producing lithium-ion batteries will be fully adaptable to sodium-ion technology

Storage for surplus renewable energy is a prime example. Some forms of renewable energy have an intermittence problem, producing electricity only when the wind is blowing or the sun is shining. Batteries are gaining popularity as a means to store excess energy locally for later use. Tesla’s gigantic lithium-ion battery in Australia, for example, was installed in response to a long state-wide blackout, to enable the wind farm to supply energy to the grid 24/7. The use of batteries alongside solar panels in homes and businesses is also on the increase in some parts of the world.

With the fraction of total energy coming from renewable energy also on the up, the developers of sodium-ion batteries view this market as an open space into which their technology could step. And while their concept is not currently available off the shelf, it is edging closer with a growing number of demonstration sodium-ion batteries now proving their salt around the globe.

The closest mimics

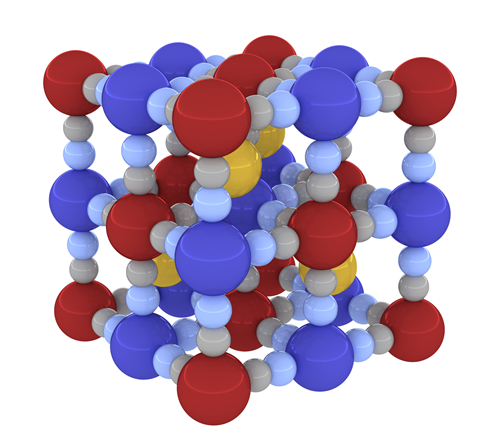

A battery resembles a sandwich, with electrodes in place of bread and electrolyte as the filling. In lithium-ion batteries, electrode and electrolyte compositions vary depending on the performance characteristics required. For most, the positive electrode – cathode – is a lithium cobalt oxide, often doped with elements such as nickel, manganese and aluminium. The negative electrode – anode – is typically a form of carbon. And lithium hexafluorophosphate (LiPF6) in a mixture of cyclic and aliphatic carbonates is the most frequently used electrolyte.

‘Just like with lithium-ion batteries, there are many different chemistries that all fall under the big umbrella of sodium-ion batteries,’ explains Knott. The most common design, however, is closely aligned with that of the most popular of their lithium counterparts: a sodium oxide cathode, a carbon-based anode and a non-aqueous solvent electrolyte.

Faradion, based in Sheffield, UK, was one of the first companies on the sodium-ion battery scene. ‘We have a range of cathode materials patented, but our preferred composition right now is a sodium–nickel layered oxide,’ explains Jerry Barker, chief technology officer at Faradion. Graphite can’t be used as the anode in sodium-ion batteries; it is not energetically favourable to put sodium in between the individual layers. Faradion is using a hard carbon anode, a popular choice amongst sodium-ion battery developers, and NaPF6 electrolyte.

Alongside batteries for renewable energy storage, Faradion is also developing replacements for lead–acid batteries in both low-cost electric transport – such as bikes, scooters and rickshaws – and for vehicle starter, lighting and ignition (SLI) purposes. ‘We’ve made more than 50kWh of prototypes, including a home storage system, e-bike and golf trolley, to show that this technology is for real,’ says Barker. ‘We are relicensing the technology now to existing lithium-ion manufacturers and new entrants in the field.’ He hopes they will hit the shelves fairly soon.

Problems arise when a material is taken from the lab to scaling up

The UK government’s £246 million Faraday battery challenge is funding some of Faradion’s transport-focused battery research through the new Faraday Institution. The company is currently working alongside Emma Kendrick, professor of energy materials at the University of Birmingham in the UK, to develop the manufacturing process of its sodium-ion SLI battery. While sodium-ion batteries can be produced on the same manufacturing lines as their lithium counterparts, tweaks still need to be made to the processes to accommodate the different material morphologies and other physical properties. ‘Sometimes you can produce new materials, put them in a half cell, test them and get a fantastic looking journal publication. But [then problems arise] when that material is taken through scaling up the manufacturing process,’ Kendrick explains.

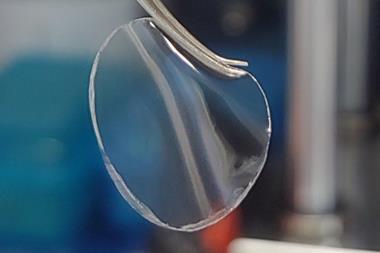

The Faraday battery challenge is also funding Caerphilly-based Deregallera to improve the energy density of anodes for sodium-ion batteries. ‘Several high capacity candidate materials exist, but unfortunately can’t be used on their own, owing to issues including extreme volume expansion,’ explains Peter Curran, principal scientist at Deregallera. ‘We surmount these problems by supporting high capacity nanoparticles on a hard carbon core.’ The company is also developing low energy scalable electrode material synthesis processes to undercut conventional manufacturing processes in cost. ‘Within 18 months, we want to have a commercially viable pouch cell,’ Curran says.

A third UK company poised to demonstrate its sodium-ion batteries publicly is Bridgend-based DST Innovations. It has developed a layered oxide cathode material and other cell technologies aimed primarily at renewable energy storage. One of their batteries ‘is designed to operate in harsh environments, where temperatures might go down to –30°C and then reach high temperatures during the summer’, explains Ben Masheder, DST Innovations research and collaborators manager. ‘That’s not something which can currently be achieved using standard lithium-ion systems.’ According to Masheder, the company’s technology ‘has been presented in private demonstrations for some considerable time. We plan to publicly reveal a wide array of demonstration units over the remaining part of 2019.’

Further afield

On the continent, a number of groups are also powering forward with sodium-ion batteries hosting oxide-based cathodes. In France, for example, Amiens-based Tiamat has a prototype battery for an e-scooter and has manufactured a couple of hundred rechargeable 18650-type batteries to date. And the German government recently funded a three-year, €1.15 million (£1.05 million) academic collaboration to scale-up lab-sized sodium-ion batteries to commercially-viable prototypes. ‘We want to optimise the chemistry inside of the sodium-ion cell to enhance the performance close to lithium-ion so that the cost of a sodium-ion cell, for its entire life, is going to be lower than that of lithium,’ explains Stefano Passerini, project partner and electrochemist at the Karlsruhe Institute of Technology in Germany. His team’s anode is particularly innovative – a hard carbon made from apple biowaste.

This year, we made a 100kWh sodium-ion battery energy storage system for grid applications

Prominent sodium-ion-focused academics in Asia include Shinichi Komaba at the Tokyo University of Science in Japan, and Yong-Sheng Hu at the Institute of Physics, Chinese Academy of Sciences in Beijing. In 2017, Hu launched a spin-off company to commercialise his academic research – HiNa Battery Technology. Its batteries contain a layered Na–Cu–Fe–Mn–O oxide cathode, a pyrolysed anthracite anode and NaPF6 in carbonates as the electrolyte. According to Hu, both electrodes are very cheap to manufacture.

‘We have now set up a material plant to produce the cathode and anode material and another plant to make the sodium-ion batteries,’ says Hu. The company has manufactured 10,000 prototypes so far. In 2017, an e-bike demonstration was revealed and, in 2018, a mini electric car and a home storage system. ‘This year, we made a 100kWh sodium-ion battery energy storage system for grid applications,’ Hu says. It comprises more than 6000 sodium-ion battery cells connected together and one is now being field tested at the Yangtze River Delta Physics Research Center in Liyang city. The battery charges from the grid during cheaper, off-peak electricity hours and then supplies the electricity to the research centre during peak times. ‘Calculations show it will take about three years to get back the initial investment for a 1MWh storage system based on the current electric price differences between peak and off-peak hours, and after that, we can make money from this energy storage system,’ says Hu. He says the same battery could also be used for renewable energy storage, and that HiNa Battery Technology is hoping to take it to market in 2020.

Sodium-ion batteries are also hotting up in Australia. Knott and his Wollongong colleagues, for example, have recently started installing sodium-ion batteries for field testing. This AU$10.5 million (£5.8 million) project is funded by the Australian Renewable Energy Agency, and the team is tight-lipped about its battery’s composition. The first installation will be in a test house that runs on solar energy. A second, larger battery is to be installed in 2020 at a Sydney Water pumping station on Bondi Beach. ‘This will be a demonstration of how these sodium-ion batteries can help increase the uptake of renewables in light industrial applications,’ Knott says.

Feeling blue

Layered oxides and carbons might be the most prolific electrode compositions for sodium-ion batteries, but they’re not the only ones possible. Natron Energy in California, US, for example, is using ferric ferrocyanide salts known as Prussian blue. ‘Prussian blue is a pigment found in all sorts of consumer products,’ explains Colin Wessells, the company’s co-founder and chief executive. Pasta was the second co-founder, but is no longer involved is the company. ‘We use two different grades of Prussian blue, one for the positive electrode and the other for the negative electrode,’ Wessells adds.

Natron Energy is currently pre-selling a battery for back-up power at data centres. ‘These batteries each provide about 8kW of power and are designed to be installed in each of the server racks in the data centre,’ says Wessells. ‘This battery is for sale today and commercial production will begin in a few months.’

The company is also testing its sodium-ion battery technology for several grid-related energy storage applications at the University of California, San Diego. It will also be installed in rapid electric vehicle charging points on the campus in early 2020. Powering these units is notoriously problematic as the massive, rapid injection of electricity required is beyond the means of the grid. Instead, stationary lithium-ion batteries are currently used. These charge slowly, from the grid or renewable technology, and then discharge very rapidly into the car battery. ‘Prussian blue is very good at storing and releasing sodium ions quickly and reversibly. Each electrode is capable of fully charging and discharging in just a few minutes and being fully charged and discharged tens of thousands of times,’ says Wessells. ‘We also have two other demonstration projects planned for next year.’

Sea views

Just one sodium-ion battery has rolled off the production line at a commercial scale to date – a saltwater-based battery for solar integration manufactured by Aquion Energy. The battery, developed in Jay Whitacre’s lab at Carnegie Mellon University in Pittsburgh, US, was on the market from 2014 until the company filed for bankruptcy in 2017. ‘We shipped many megawatt hours around the world and have many installations that are still functioning,’ explains Whitacre. Aquion Energy ‘was purchased by Chinese interests and they are now setting up the factory in China’, he adds.

The potential of saltwater-containing batteries is being explored by a handful of other companies too. According to Whitacre, aqueous electrolytes are desirable for a number of reasons. ‘The water-based electrolyte is completely benign,’ he explains, ‘and you can have much thicker electrodes because ionic transport in water is much better than the ionic transport in organic solvents.’ Thicker electrodes are cheaper and easier to manufacture, he adds.

The anode in the Aquion Energy battery is a carbon-coated sodium titanium phosphate composite and the cathode is manganese oxide. Whitacre’s research group is currently working to develop next-generation electrodes with higher capacities.

Solidifying matters

A solid ion conductor is another option being considered for sodium-ion battery electrolytes. A family of sodium zirconium silicon phosphorous oxides, known as Nasicon, is the most explored for this purpose to date. Solid-state electrolytes are also an area of intense research interest for lithium-ion battery technology. ‘We are looking at new solid-state materials for sodium-ion electrolytes,’ explains Islam. There are lots of challenges here, he says, including the fact that solids often don’t conduct as well as liquids; there are also interface issues between all the solid components in the battery.

Passerini’s German collaboration, Pasta’s Oxford research group and Hu’s team are also looking at solid sodium-based electrolytes. The latter has also started exploring ionic liquid electrolytes too. Other sodium-ion technologies in the early stages of development include sodium–sulfur (similar to lithium–sulfur) and sodium–oxygen (analogous with lithium–air). The possibility of going one across in the periodic table, to magnesium, is also being considered.

But whether or not sodium-ion batteries will ever hit the mainstream remains to be seen. ‘It’s difficult to predict because you need a market pull, as well as a technology push,’ says Kendrick. ‘That pull is not really there at the moment.’ Other researchers are much more positive about the field’s future. ‘It’s an exciting time for sodium battery research,’ enthuses Islam. ‘But whichever direction the future of batteries takes, major breakthroughs will depend on new materials, new concepts and a greater understanding of their performance.’

Nina Notman is a science writer based in Salisbury, UK

No comments yet