Imfinzi and tremelimumab checkpoint inhibitor pairing fails to beat chemotherapy in lung cancer

Almost £10 billion has been wiped from Anglo-Swedish pharma giant AstraZeneca’s stock market valuation after much-anticipated immuno-oncology trial results failed to show benefit over standard lung cancer therapy.

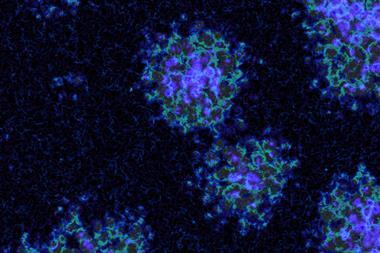

The MYSTIC Phase III trial in non-small cell lung cancer (NSCLC) combined two different ‘checkpoint inhibitor’ antibody drugs, Imfinzi (durvalumab) and tremelimumab. It didn’t meet its primary endpoint, which was to extend the time during and after treatment in which patients’ cancers didn’t worsen further than chemotherapy. However, the trial will continue looking at how long patients survive on the combination, and on Imfinzi alone, with results due in late 2018.

With immuno-oncology one of the hottest areas in the pharmaceutical industry, the stakes are high for AstraZeneca. The leading checkpoint inhibitor drug, Keytruda (pembrozilumab) from AstraZeneca’s US rival Merck, remains dominant in NSCLC, being given in some cases as an initial treatment along with chemotherapy.

AstraZeneca had hoped to join Merck as a leader in that market, leapfrogging Bristol-Myers Squibb’s Opdivo (nivolumab), which similarly failed to beat standard chemotherapy in NSCLC in August 2016. So far, Imfinzi has only been approved by the US Food and Drug Administration for use in bladder cancers after an initial chemotherapy treatment has failed.

However, on the same day as the MYSTIC trial results, AstraZeneca said it will collaborate with Merck to co-develop and co-commercialise combination cancer therapies with Imfinzi and Keytruda. The deal will see each immunotherapy partnered with two AstraZeneca small molecule drugs: the poly ADP ribose polymerase (PARP) inhibitor Lynparza (olaparib) and its more conventional kinase inhibitor selumetinib. As part of the agreement, Merck will pay AstraZeneca up to $8.5 billion (£6.5 billion) in total, including $1.6 billion upfront.

No comments yet