Perennial problem will not be addressed without major reforms to drug market

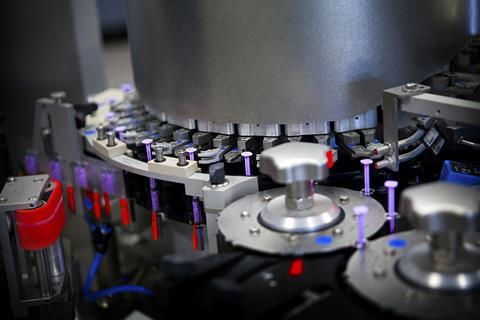

On 20 July, a tornado tore through a Pfizer plant in Rocky Mount, US, destroying part of a large facility that makes sterile injectable drugs. The twister caused extensive damage to warehouses storing critical hospital supplies such as dopamine, potassium acetate and vitamin K1 for babies.

The facility manufactures a quarter of Pfizer’s sterile injectables for US hospitals, comprising around 8% of total US consumption. While production facilities remained largely unscathed, they had to be stopped. ‘In this highly sensitive, sterile environment, when you are losing power, it is not easy to switch on and switch off,’ said Pfizer’s chief executive Albert Bourla. There were therefore immediate concerns from drug purchasers about drug shortages after the tornado hit, although a statement from the US Food and Drug Administration (FDA) said there was some redundancy in the supply chain.

An initial FDA analysis pinpointed fewer than 10 drugs for which the Rocky Mount plant is the sole source for the US market, with Pfizer itself outlining 12 products of concern. Nonetheless, the disruption caused alarm amongst drug purchasers because there are already hundreds of drugs listed as in short supply in the US.

The issue is not new. A 2019 FDA report on drug shortages spotlighted three root causes – a lack of incentives to produce less profitable drugs; a lack of reward for implementing quality systems that offer improvements in reliability; and logistical and regulatory challenges making it difficult to recover from disruptions. The Covid-19 pandemic drew further public and political attention to the issue of pharmaceutical supply chains and shortages.

Persistent predicament

But the problem remains. Drug shortage statistics compiled by the University of Utah Drug Information Services listed 309 drugs as short in the second quarter of 2023, the highest level in almost a decade. According to its statistics, posted online by the American Society of Health-System Pharmacists (ASHP), the top five drug classes impacted are central nervous system, antimicrobials, fluids and electrolytes, cancer chemotherapy and hormones.

‘Over the years, the drug shortages haven’t changed much in which kind of drugs are short,’ says Erin Fox, who has run the Utah drug shortage tracker for more than two decades. ‘It is almost always a low-cost, generic drug, and usually a sterile injectable.’ These drugs are made in facilities that have streamlined efficiencies to reduce cost, often with high volumes but little profit margin.

Over the years, the drug shortages haven’t changed much. It is almost always a low-cost, generic drug, and usually a sterile injectable

If a plant stops production, another facility cannot simply step in to meet market demand, given that it takes time to build and for a regulator to certify a factory. Generic production plants tend to optimise heavily until they have no slack, no spare capacity, says Ivan Lugovoi, a professor of pharma supply chain management at Kühne Logistics University in Hamburg, Germany. ‘Pricing for these drugs does not account for the high investment required in quality management,’ he adds.

Generics make up more than 90% of prescriptions in the US. ‘Most sterile injectables are older products, but they are effective products, often used in critical care,’ says Stephen Schondelmeyer, pharmaceutical economist at the University of Minnesota, US. ‘They aren’t necessarily rocket science, but they’re critical products that we need to have on the market.’ The production plants are complex, but the products sell for a few dollars.

When US drug manufacturer Akorn filed for bankruptcy in February 2023, it closed all operations and recalled dozens of its generic medications. In some cases, it was the only supplier. ‘It was extraordinarily disruptive and created a lot of shortages,’ says Fox, who adds that everyone was worried the Pfizer plant incident would have a similar impact. Akorn’s collapse created multiple shortages, including dimercaprol – an antidote for heavy metal poisoning. Another antidote – edetate calcium disodium (EDTA) – was also in short supply at the same time.

Part of the problem, according to Fox, is that generics compete only in terms of price. This encourages a race to the bottom in terms of trimming costs, and skipping quality management steps deemed dispensable.

Low profit margins mean less resources to invest in updating factories. A recent report from the Brookings Institution think tank in the US, noted that price pressures create strong incentives for manufacturers to not upgrade their facilities; to overuse existing equipment; and to skimp on proper staffing and oversight. One consequence is quality shortfalls.

There is such thing as a public good drug, a drug needed in the market and that the government should find a way to incentivise

Quality problems at Intas Pharmaceuticals in India left doctors scrambling for crucial cancer drug cisplatin. In November 2022, FDA inspectors found its plant in Gujarat state lacked basic procedures for checking purity or sterility, and that employees had shredded documents related to quality control. The plant, which produced about half the US’s supply of cisplatin, was shut down.

Patients suffered. ‘There were doctors and pharmacists who had to go tell the mother of a little child, we are sorry, but we don’t have the drug to treat your child’s cancer,’ says Schondelmeyer. ‘The number of suppliers of generic drugs, especially sterile injectables, has shrunk,’ he adds. ‘There’s been lots of mergers and acquisitions.’ There is additional manufacturing capacity in countries such as India and China, but they are not certified to sell into North American or European markets. For cisplatin, the FDA allowed a non-approved Chinese manufacturer to temporarily help address the critical shortage.

The US continues to suffer from chemotherapy shortages. ‘This is very frustrating,’ says Fox, ‘because we really don’t have a lot of good alternatives, and it really does come down to rationing.’ But quality failings cannot be ignored, as the potential consequences are serious. For example, in February, eyedrops made in India were contaminated with extensively drug-resistant Pseudomonas bacteria and infected dozens of people in the US, prompting the Centers for Disease Control and Prevention to issue a health warning. Meanwhile, hundreds of fatalities in Africa and Asia have resulted from distribution of contaminated cough syrups.

Essential interventions

There are proposed solutions. ‘We must change the behaviour of hospitals, so they pay a little bit more for these products,’ says Fox. For now, every generic drug is now considered equal, so that the only way they compete is price. A new approach could see a rating system based on quality.

Indeed, the 2019 FDA report recommended a rating system to incentivise drug manufacturers to invest in quality management and promote private sector contracts that emphasise reliability of supply. ‘Perhaps payers would reimburse hospitals only if they bought four- or five-star products,’ says Fox, rather than cheaper products rated lower in terms of quality of manufacturing. ‘We’ve overpaid for patented drugs and probably had over-competition for generics,’ says Schondelmeyer.

Lugovoi worked with the FDA on proposed solutions. One was to build up stockpiles, to buffer against shortages, and another was to construct multifunctional manufacturing facilities that the FDA itself would run in situations of inadequate supplies of a vital medicine. This way there are fewer intellectual property issues or inspection problems.

But the FDA favours a predictive model that could identify potential or looming shortages. This is partly because the agency is not mandated by Congress to ensure steady drug supply. ‘The FDA isn’t granted authority over economic factors or market factors of drugs,’ says Schondelmeyer.

He too sees a need for governments to step in over societal concerns. For instance, in cases where demand for a drug is so small that there is little profit from investing in its production. ‘There is such thing as a public good drug, a drug needed in the market and that the government should find a way to incentivise,’ Schondelmeyer says. Healthcare providers may need to pay extra for low-cost generic drugs, he suggests, just to keep supplies on the market.

We need a system with enough redundancy, resilience and economic incentives that low cost products get made and are always available

Other approaches have been adopted. In 2019, Phlow was launched as a public benefit corporation in the US to develop and domestically manufacture active pharmaceutical ingredients and finished pharmaceutical products ‘that are critical to the nation’s health’.

Schondelmeyer and others argue that if you rely solely on the market to supply essential drugs, then there will always be some less profitable drugs in short supply. One approach would be to treat the pharmaceutical industry and supply of drugs like a strategic industry, akin to how Western countries view the defence and energy sectors. ‘You don’t make tanks in China,’ says Lugovoi. ‘You do it in the US or Europe, because it is a question of national security.’

A global concern

While Europeans and Americans assume vital drugs will be available, some hospitals spend a great deal of time and money chasing supplies or sourcing alternatives. This itself leads to unequal access. Larger and better funded hospitals can afford to employ someone to source scarce medicines and buy in bulk. ‘Single, rural hospitals have a harder time,’ says Fox.

It can often be difficult to identify where a particular drug is made. ‘The companies can be quite secretive,’ says Lugovoi, though Pfizer won praise for quickly disclosing drugs impacted by the Rocky Mount tornado. A US Senate report noted that the FDA still generally lacks information that could help mitigate shortages, and that manufacturers are not required to report increased demand or export restrictions for crucial drugs.

The attention the problem has gained in recent months has buoyed some experts. ‘I’m feeling optimistic,’ says Fox. ‘There are several bills in Congress that can help.’ The Mapping America’s Pharmaceutical Supply (MAPS) Act would require a government database to be created that maps vulnerabilities in the pharma supply chain to pinpoint weaknesses. It would note the origin of each drug, the plants that manufacture them and possible risks.

Europe is a little further behind, says Lugovoi. The US has more data on drug shortages, he adds, although he is hoping to start working on this issue in Europe. The supply maps for drugs are global in nature. ‘Probably 70–80% of our drug supply map is the same in the US and Europe,’ says Schondelmeyer. He is involved in the Resilient Drug Supply Project, which is developing a detailed map of the supply chain for critical US drug products. ‘We need collaborations between the US and Europe and other industrialised countries to develop policies globally,’ says Schondelmeyer. It is not about one country being self-sufficient in essential drugs, but rather about diversifying supply and ensuring it is robust.

‘We need a system that has enough redundancy, resilience and economic incentives that low cost products get made and they’re always readily available in the marketplace,’ says Schondelmeyer. ‘If we do that, we can end drug shortages, not just reduce them.’ There are many proposals, but for now little concrete action, and drug shortages remain a fact of life.

No comments yet