For the past 10 years, graphene has popped up in many headlines. Emma Stoye looks at whether current progress matches up to the promises

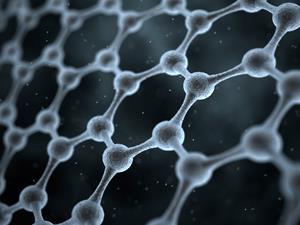

The wonder material. It’s just one atom thick but 200 times stronger than steel; extremely conductive but see-through and flexible. Graphene has shot to fame since its discovery in 2004 by UK-based researchers Andre Geim and Konstantin Novoselov, for which the University of Manchester pair were awarded the 2010 Nobel prize in physics.

We’ve heard the facts. We’ve read about how graphene could push the boundaries of today’s technology in almost unlimited ways. We’ve even pictured an elephant balanced on a pencil. But looking past the headlines, it’s clear that a lot of the most exciting areas of graphene science are still in the early stages. It will be years, decades perhaps, before we see the first graphene-enhanced smartphones, aeroplanes or bulletproof vests. But beyond these pie-in-the-sky promises, the underlying research is gathering pace.The wonder material. It’s just one atom thick but 200 times stronger than steel; extremely conductive but see-through and flexible. Graphene has shot to fame since its discovery in 2004 by UK-based researchers Andre Geim and Konstantin Novoselov, for which the University of Manchester pair were awarded the 2010 Nobel prize in physics.

Fast progress

‘If anything, the progress of graphene has been quicker than other comparable materials,’ says Andrea Ferrari, director of the Cambridge Graphene Centre at the University of Cambridge, UK. He points out that for the first few years after graphene’s discovery in 2004, most research was restricted to academia, and was fundamental physics. ‘It was only around 2009/2010 that applied university departments and companies really started taking notice of this material – we are just four years in.’

There has been a surge in graphene-related patents over the last few years – the total number published more than doubled from 2012 to over 9000 in 2014. More than three quarters of these were filed in China (47%), Korea (13%) or the US (18%).

Closer to home, graphene R&D has attracted several hefty dollops of public investment. In the UK this year, the £61 million Manchester-based National Graphene Institute (NGI) opened with £38 million from the UK government. And the Graphene Flagship initiative was one of the big winners at the European commission’s future and emerging technologies competition. It received €54 million (£39 million) from Framework Programme 7 in 2013–2016 and is scheduled to get €50 million a year from the Horizon 2020 budget, all to support both fundamental and applied research. To date, the project has more than 140 partner organisations in 23 countries, and it recently released its roadmap for graphene research, which Ferrari is coordinating.

Lightbulb moment

A landmark moment came just a few months ago, when the UK’s first graphene-enhanced commercial consumer product was unveiled – a lightbulb produced by Graphene Lighting, a company spun out from the University of Manchester and the NGI.

The bulb’s developers have been somewhat secretive about how the technology works, saying only that the bulb contains a filament-shaped LED coated with graphene, whose superior conductivity makes the whole thing around 10% more efficient, as well as longer lasting. It is also cheaper to manufacture, and boasts ‘more sustainable’ components, says Colin Bailey of the University of Manchester, one of Graphene Lighting’s directors. ‘We expect these to go to market by the end of this year,’ he says. ‘We’ve got a supply chain in place.’

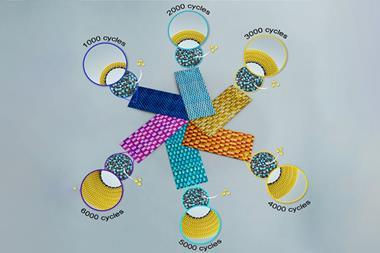

He adds that the NGI has other devices on the way in the near future, including an antenna made of graphene ink that can be printed on paper, opening up the possibility of cheaper radio frequency identification tags and wearable wireless sensors. Bailey estimates this will be market-ready in 2016. ‘We’re just looking for the capital to support the factories and the supply chain that we require,’ he says. ‘We’ve also got many other things in the pipeline – we’re looking at graphene coatings on, for example, steel masonry, looking at batteries that can be re-charged a lot quicker and hold a lot more energy and also graphene in composites.’

Indeed, graphene-containing composites are likely to be some of the first major mainstream applications of graphene, owing to the relatively low cost of producing fragments of graphene in solution by liquid-phase exfoliation of graphite. Incorporating small amounts of graphene into other materials such as alloys or polymers can lead to exponential increases in strength or conductivity, which will enable manufacturers to produce better protective paints and coatings, conductive inks for 3D and inkjet printing or stronger building materials.

The Graphene Flagship’s roadmap predicts more and more graphene-infused inks and materials will start hitting the market within the next few years, and some companies have started producing them already. Composites manufacturer Haydale Graphene Industries has incorporated graphene nanoplates into epoxy resins and carbon fibre reinforced polymers, and are currently collaborating with yacht racing team Alex Thomson Racing to try and build stronger-but-lighter vessels and develop performance-enhancing coatings.

US sports equipment manufacturer Head caused a stir in 2013 with a tennis racquet which uses a graphene-enhanced polymer in the shaft, shifting the weight distribution. This gives a racquet with the same ‘swing weight’ that is 20% lighter overall, the company claims. The product has been a big success for Head, and the company’s patent also covers the material for use in other sports equipment, including skis and golf clubs. ‘This is really going very fast, and this is where I think it’s really surprised the market,’ says Bailey.

Keeping up standards

The speed of progress of graphene-based devices and materials is closely tied to the ability to manufacture them in large quantities. At this stage, methods that produce the best quality single layer graphene, such as mechanical exfoliation (the sticky-tape method) and chemical vapour deposition (CVD), are not currently cost-effective enough to be suitable for bulk production, and are still largely restricted to R&D. While this has been one factor in holding back some of the high-tech applications of graphene that require large, defect-free single-layer sheets, the technology for producing other materials, such as flakes of few-layer and multi-layer graphene, has begun to get off the ground.

‘There used to be about 100 companies involved in graphene production two years ago … now it’s about 300,’ says Terrance Barkan, director of the Graphene Council, a network for those involved in research, development and production of graphene.

While this growth is a promising sign in many ways, Barkan warns it can also create problems. ‘Every day there’s a new company that purports to be producing graphene, but there are absolutely no universally agreed standards for this material … people are calling single walled nanotubes “rolled-up graphene”, or you’ve got material that is single-layered or multi-layered and it’s all being referred to as graphene. Unless you’re involved in the use of graphene on a regular basis, it is easy to get confused by all the different terminology.’

There have even been cases of inconsistency from within the same supplier, says Barkan, leading to buyers getting batches of material with slightly different properties. This creates a lot of confusion, and makes it very risky for companies to start substituting traditional, well-characterised materials with graphene in their products.

It’s easy to get confused by all the different terminology

To address this, the Graphene Council is working on creating a set of standards that can be used to characterise all the different variations on graphene across the industry. This is also an area the Graphene Flagship has been active in, and last year researchers from across Europe developed a ‘family tree’ to sort and classify different types of graphene and related materials.

‘Standardisation is not exciting,’ says Barkan. ‘It doesn’t produce any revenue – people hate it! But I would argue if you don’t overcome this obstacle you will never get to a serious, broadly integrated commercial market.’

Finding a killer

While it has been undeniably exciting to see the first graphene devices emerge, cynics have been quick to point out that light bulbs and tennis racquets are perfectly capable of functioning without it. It is still unclear when things that are completely new will be made, and even what they will be.

‘It’s quite difficult at the beginning of a field to actually have the correct idea of where the “killer application” is going to be,’ Ferrari says. To glimpse what may happen further down the line, he says we need to look at the histories of similar materials. For example, diamond-like carbon – amorphous carbon that displays some properties similar to diamond but does not have a crystalline structure – was first developed in the 1970s, and at that time, like graphene, it was suggested the material could be used in transistors.

‘But no functional transistor made with diamond-like carbon has been sold in the past 50 years,’ Ferrari says. ‘On the other hand, this material has been totally successful in other areas – every single computer hard disk in the world would not function without the layer of diamond-like carbon on the top. At the moment there are a billion computers like this being produced every year ` but of course no one in 1970 had any idea what was going to be the killer application 40 years later.’

At the moment nobody knows what graphene’s killer application will be, but many of its properties point to its potential in electronics. Much of Ferrari’s research has been focused on developing flexible electronics, making use of graphene as a conductor that is transparent, bendy and thin. In partnership with Cambridge-based company FlexEnable, Ferrari’s group produced the first graphene-based flexible display last year, an e-reader-style reflective display which uses flexible graphene electrodes in place of metals and bendy plastic instead of glass for the screen.

Mobile phone giants Samsung and Nokia have also set their sights on graphene-based flexible electronics, pouring millions into projects to develop bendable screens that use graphene in place of the brittle, unbending indium tin oxide layer used to make the touch screens found in today’s smartphones and tablets. Although Samsung is said to have produced a few working prototypes, the expensive CVD process needed to make the graphene still presents a challenge, and they are not yet available to buy.

There is also talk of replacing the silicon in chips, as our ability to build smaller and smaller chips containing greater number of transistors begins to slow down. But that is a long way ahead, warns Ferrari: ‘I’m never going to be able to replace the silicon transistor with graphene – not in my lifetime.’ He adds it could be at least another 20 years before many of graphene’s electronic applications are ready to enter the market, and he warns a great deal more investment will be required.

‘The headline “€1 billion for graphene” looks great, but then it looks peanuts when you think that one single semiconductor company might spend several billion dollars over 10 years just to make a single device slightly smaller,’ Ferrari says. ‘What we have at the moment for graphene is really the very beginning.’

Changing the world

For Tim Harper, a technology consultant involved in running several high-tech start-ups, there are other world-changing graphene technologies that may be far closer to becoming reality. The real winners of the ‘graphene race’, he says, will be those who are able to translate the technology into applications where there is already market demand.

‘If you’re going round with a bag of graphene trying to find an application for it it’s a tough call,’ Harper says. ‘If you can find a way of using graphene to do something that nobody else can do then you’ve got a business.’

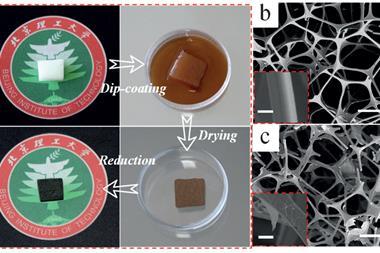

We think we can get to market within a couple of years

One area in which Harper thinks graphene materials show particular promise is water purification. He recently founded UK-based company G2O, which has licensed graphene oxide membrane technology developed at the University of South Carolina, US. The water filtration membranes are made by coating a polyamide substrate with flakes of graphene oxide, which overlap and wrap around the polyamide fibres to ‘mimic the mucus layer on top of fish scales’, says Harper. When a mixture of oil and water is exposed to the membrane, the graphene oxide flakes trap water inside the structure, creating hydrophilic pockets that repel the oil. This makes the membrane very resistant to fouling, which is a common problem with most purification membrane technology.

‘Water treatment costs are extremely high at the moment,’ says Harper. ‘But once you start coating these membranes, suddenly the amount of water you can get through increases, and other things don’t foul, and that translates to massive savings. If you look at a typical desalination plant, we can save probably 40% of the energy costs.’ That could save a plant up to $40 million (£26 million) every year, and Harper hopes the figures are promising enough to convince water treatment and desalination companies to fund the scaling-up of this technology.

Another company he is involved with, Xefro, is trying to design the perfect heater. ‘Using printable graphene inks we’ve come up with heaters that can be moulded into different shapes that can be integrated into the fabric of buildings,’ Harper says. Initial tests suggest combining the technology with control systems that can modulate the heating in each room of a house could achieve energy savings between 25% and 70%, depending on how well insulated the rest of the house is. ‘We can come up with a solution that can keep heating costs down 50–60%,’ says Harper.

These ideas seem futuristic, but Harper is keen to stress that with the right investment they could become reality much sooner than you might expect. ‘I’m not looking at a 10-year research project, I’m not looking at a five-year research project,’ he says. ‘This is something we think we can get to market within a couple of years.’

Though some areas are progressing faster than others, the wonder material doesn’t show any signs of leaving the spotlight. As a technology just beginning to attract the attention of investors and industry, Ferrari describes graphene as a ‘new-born baby’. There can be no doubt that before too long it will begin to take its first steps.

Amended 08 July to correct funding amounts for Graphene Flagship

No comments yet